Like most things in life, your response to money is largely dictated by your personality, life experiences and beliefs.

We often stress the importance of financial literacy, such as gaining a strong understanding of how money works and having the resources to make informed decisions. But one thing most people fail to consider is their money personality type and the impact it has on their approach and mindset towards money.

This article explores 7 money personality types and the common pitfalls the different types face. By understanding your type, you can develop a plan to achieve better financial health and a happier relationship with your money.

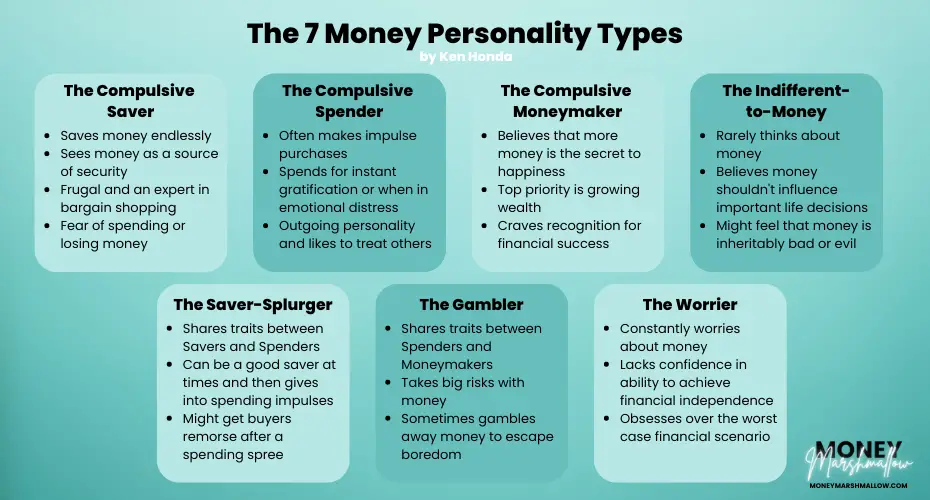

7 Money Personality Types

The author of Happy Money, Ken Honda, is an expert in the psychology of money and happiness. Based on his theory, there are seven distinct money personality types. Most of us are a combination of various types, and not just one.

Identifying your money personality types and understanding the pitfalls can help you build a healthier relationship with money. It can help you control impulse purchases, improve your budgeting skills, invest wisely and generally enjoy your money more.

With this in mind, here are the different money personalities and how you can deal with the personality type you identify with:

1. The Compulsive Saver

The signs of a Compulsive Saver:

- You put away money endlessly, at times with no actual end goal in mind.

- You derive security from the belief that saving money is the only way to feel more secure in life.

- You’re very frugal. (Friends might often come to you to find out about the best bargains and deals.)

Pitfalls: Compulsive Savers can be so afraid of losing money that they go their entire lives spending barely any of what they worked so hard to save. For example, they might choose to skip out on meeting friends or hobbies and activities that could bring them happiness and purpose. Typically, this money personality type is also very risk-averse, avoiding investing and therefore the chance of building real wealth.

Money tip: While saving and frugal living are often good, life is all about moderation. After all, money is a tool to create the life you want. Set specific, achievable goals for your savings. Is it a dream vacation, a down payment on a house, or early retirement? Then, create a budget that allocates some money for fun and experiences alongside your savings goals. This will help you find joy in the journey towards your financial dreams.

2. The Compulsive Spender

The signs of a Compulsive Spender:

- You tend to spend money on impulse purchases and things you don’t necessarily need, regardless of your financial situation.

- You have an outgoing personality and love throwing parties or treating people to something special, even for no particular reason. You might spend your money to have others think more highly of you.

- When you’re in emotional distress, your solution is to spend, especially for instant gratification.

Pitfalls: Compulsive Spenders will often continue going on shopping sprees, even if they have large amounts of credit card or ‘Buy now, pay later’ debt. They may even try to hide large purchases from their partner, family and friends. In extreme cases, they can be at risk of going bankrupt if they keep spending above their income.

Money tip: That rush after a purchase can be fleeting. There’s a deeper happiness that comes from experiences and strong connections, not just material possessions. Let’s build a budget together that reflects what truly matters to you. Think about the activities and people that bring you joy. Prioritize those in your budget, alongside a small “fun money” category for occasional treats. This balanced approach can help you achieve your financial goals and experience lasting fulfilment.

Related: Why do lottery winners go broke?

3. The Compulsive Moneymaker

The signs of a Compulsive Moneymaker:

- You believe that earning more money is the secret to happiness.

- You spend most of your time and energy trying to make as much money as possible. You are likely running after promotions, working on multiple side hustles or job hopping to elevate your financial status.

- You get pleasure from the approval and recognition from other people for your financial success.

Pitfalls: Compulsive Moneymakers are usually on a strong path to achieving financial freedom. However, they can enter dangerous territory if they start neglecting health or important relationships to prioritise growing their wealth. For example, they might be choosing to work late nights over spending time with family.

Money tip: Accept that there’s more to life than money. Consider setting goals that extend beyond the next paycheck. This could involve spending more quality time with loved ones, pursuing a passion project, or travelling to a dream destination. Creating a budget that allocates for these experiences can help you find balance and appreciate the present moment. Remember, your wealth can also be a tool for good. Think about causes you care about or ways to support your loved ones. Giving back can bring immense satisfaction and create a deeper sense of purpose.

4. The Indifferent-to-Money

The signs of an Indifferent-to-Money personality:

- You rarely think about money (and just the idea of creating a budget or investing makes you nauseous).

- In extreme cases, you believe that money is inherently bad or evil and that it would be corrupting to have too much of it.

- You feel strongly that money shouldn’t influence important decisions in life.

Pitfalls: Many people who are indifferent to money feel they don’t need too much money to be happy, which is a healthy mindset in principle. But things can get difficult if they’re not responsible with their finances or don’t understand how money works. Even if their partner or spouse manages the finances, it’s important to understand the basics of personal finance.

Money tip: Knowing where your money goes (think bills, subscriptions, savings) takes minimal effort and can prevent future headaches. A quick monthly check-in can ensure you’re not accidentally overspending or missing out on better deals. It’s like a financial safety net – catching surprises before they become stressful.

5. The Saver-Splurger

The signs of a Saver-Splurger:

- You share common traits between Savers and Spenders.

- You start out saving a lot of money but then give in to spending impulses.

- When you do use your savings, you might spend on things you don’t need or will rarely use.

Pitfalls: It can be emotionally exhausting to constantly swing from compulsive saving to compulsive splurging. Saver-Spenders often end up stressed and disappointed in themselves for working so hard to save money, only to spend it so quickly. This personality type often lacks the needed discipline to secure their finances long-term.

Money tip: Similar to Compulsive Spenders, set some financial goals and a budgeting system that can help you deal with your life priorities. Allocate a portion for your savings goals (dream vacation, new car, etc.) and another for planned “splurges.” Knowing these fun purchases are accounted for can help you stick to your saving goals and make your splurges even more enjoyable. And before a big purchase, ask yourself the “joy meter” question: Will this bring me lasting happiness, or is it a fleeting feeling? This simple check can help you avoid buyer’s remorse and ensure your splurges contribute to your overall financial well-being.

Related: How hedonic adaptation can impact your personal finances

6. The Gambler

The signs of a Gambler:

- You share common traits between Moneymakers and Spenders.

- You find thrill in risking a lot because of the hope of reward and the pleasure that such a reward could bring.

- At times, you gamble away your money just to escape boredom.

Pitfalls: It’s not unusual for Gamblers to encounter big wins or devastating losses. In an extreme case, gambling gets out of control and the Gambler might dip into things like their retirement savings to make up for losses along the way.

Money tip: Do you crave excitement? Channel it into your financial future! Before taking any big financial risks, prioritize building a safety net. Set aside money for an emergency fund and long-term goals. This financial cushion allows you to explore calculated risks without jeopardizing your security.

7. The Worrier

The signs of a Worrier:

- No matter how much money you have, you’re constantly worried about losing it.

- You are likely to have a scarcity mindset and you lack confidence in your abilities to achieve financial independence.

- You constantly obsess over what could happen if you run out of money.

Pitfalls: It’s smart to think about what could happen if you don’t financially prepare for your future. But letting worry and anxiety eat away your happiness in the present moment is never a good thing. It’s good to remember that keeping your money stashed at home or in a low-interest bank account won’t keep pace with inflation.

Money tip: Understanding the root of your financial anxieties is a powerful first step. Consider talking to a trusted friend, family member, or financial advisor or coach. They can offer support and guidance as you navigate your finances. By identifying the source of your worry, you can develop a plan to build financial security. This can empower you to feel more in control and help your money work towards your goals.

Final thoughts

Understanding your own money personality isn’t an excuse for certain behaviours; it’s a helpful tool for self-awareness. Recognizing your dominant personality traits, spending habits, and emotional responses to money allows you to develop healthier financial behaviours. This newfound knowledge can empower you to make more mindful financial decisions and cultivate positive financial habits.

There’s a financial approach that aligns with your unique personality, whether you’re a budget-conscious saver or have a soft spot for splurges. Explore the different financial personality types, gain control of your finances, and build a plan that reflects your dreams. Finally, remember that a healthy relationship with money is a journey, so start yours today and watch your financial wellbeing blossom.

Love these! I was the worrier for a long time. But thankfully am getting better about it. Great post!

This is interesting to know which one you are. I’m definitely not a gambler haha. Don’t like to spend money blindly.

I would say I am, in a way, The Saver-Splurger! Thanks for sharing this. 🙂

I’m definitely the worrier!