Do you ever find yourself daydreaming about something you want, convinced it will unlock a whole new level of happiness?

It could be a better job, a fancier car or a bigger house. But if you look around at what you already have, there was likely a time when you thought that once you obtained those things, you’d be happier. Briefly, they may have boosted your happiness. But eventually, your level of happiness levels returned to normal and you began to desire new things. You might have just been caught in a hedonic treadmill aka hedonic adaptation.

Let’s explore more what hedonic adaptation is and how it can impact your personal finances.

What is hedonic adaptation?

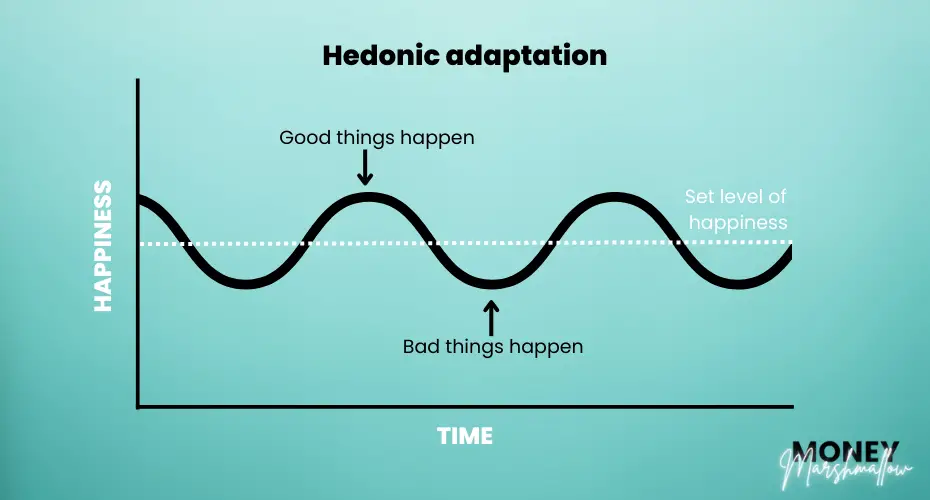

The theory of hedonic adaptation, also known as the hedonic treadmill, proposes that individuals tend to return to a baseline level of happiness, or “set point,” following both positive and negative life events. This concept describes how we acclimate to both positive circumstances that evoke strong positive emotions and negative events that trigger distress. While positive emotions experienced after a good event may initially be intense, this feeling tends to diminish over time. Conversely, the negative emotions associated with negative events may cause a temporary decline in happiness. Again, we generally adjust to these as well and return to that relatively stable level of happiness.

To illustrate this hedonic treadmill theory, a 1978 study titled “Lottery Winners and Accident Victims: Is Happiness Relative?” examined how people adjust to different life changes. The study revealed the following findings:

- Lottery winners initially felt good about their winnings but reported less enjoyment from everyday activities than the control group (people who hadn’t won). Interestingly, lottery winners weren’t generally happier than the control group in the long run. This supports the idea of happiness “set point” – even with a major positive event, happiness tends to return to a baseline level over time.

- The study also included individuals who had been paralyzed in accidents. While their happiness understandably decreased after the accident, most expected their happiness to eventually return to their own personal “set point.” This finding again highlights hedonic adaptation – even for significant negative events, people tend to adjust and their happiness levels eventually return to a baseline.

How hedonic adaptation can impact your personal finances

While hedonic adaptation can impact different areas of our lives anywhere from romantic relationships to the experience of physical pain, it’s often very relevant when it comes to money and its impact on happiness.

This cognitive bias means that no material possessions will bring us long-term happiness. Unless we truly examine why we are making a purchase, we will likely keep reaching for another thing to get momentary pleasure. But each new thing will quickly become the new normal, prompting another purchase.

Hedonic adaptation also explains why financial stress can persist even after a pay raise or windfall. While your happiness might get a temporary boost from the improved finances, the excitement is likely to fade over time, and your baseline level of stress might return.

Moreover, hedonic adaptation often leads to something called lifestyle inflation that can have a huge impact on your overall financial wellbeing. For many people, each new raise, promotion or windfall brings new luxuries, bills and purchases. This lifestyle inflation then slowly swallows up more and more costs. It’s also one of the reasons why it’s common for high-income earners to end up living from paycheck to paycheck.

This is why behavioural economists often refer to hedonic adaptation as the hedonic treadmill; you keep spending more and more money just to maintain your happiness.

However, the good news is that there are ways you can harness the power of hedonic adaptation to improve your financial wellness and personal happiness.

Hedonic adaptation: How to make it work for you

Now that we have a better understanding of hedonic adaptation, we can use its principles to build a happier life with healthier finances. Here are six ways you can make the hedonic treadmill work for you.

1. Recognise the impact of hedonic adaptation

Not all experiences trigger the same level of adaptation, and individual responses can vary. The first step is therefore to recognise the impact of hedonic adaptation in your own life. Explore your individual patterns and learn what triggers a stronger adaptation response in you.

Perhaps you received a promotion, bought a fancy car, or splurged on designer accessories. While these might have initially boosted your happiness, how do you feel about them now? The initial thrill has likely faded, and you’ve probably adjusted to having them. This is likely prompting you to consider what you might desire next.

2. Know your values

But there’s a positive side here, too – understand what’s most important to you, and make financial decisions based on those priorities. For example, if you value personal growth and learning more than the newest gadgets, you might prioritise enrolling in a skill-building course over upgrading your phone every year.

If you make a list of what truly matters to you and then base your financial choices on that list, it’s easier to avoid lifestyle inflation. When you can avoid spending money on things that don’t bring lasting happiness and contribute to your meaningful goals, you have more to spend on the things that do.

3. Slow down pleasure

Dan Ariely’s book The Upside of Irrationality explains how to space purchases to increase happiness. The key to changing the adaptation process is to interrupt it. For instance, spending money on occasional small pleasures makes you happier than having one big shopping spree.

After a shopping spree, your happiness will spike but will soon wear off as your purchases lose their novelty. If you buy smaller things more frequently, you might not reach the same level of initial happiness, but your happiness will be continuously revitalised because of the repeated changes. This means that by using the intermittent approach, you can create a higher overall happiness level for yourself.

4. Focus on temporary experiences

You can also maximise your overall life satisfaction by shifting your spending away from products and services that provide you with a constant stream of experiences. Instead of focusing on things you use all the time, consider life experiences that are more temporary and fleeting. For example, a new car or gadget becomes familiar quickly, so it’s easy to adapt to them. On the other hand, transient experiences like a concert or a weekend getaway are fleeting, so you don’t adapt to them as easily. The long-term effect of a new car on your happiness is likely to be much lower than you expect, while the joy of memories from the getaway will probably last much longer.

Related: The Diderot Effect: Why you buy things you don’t need

5. Avoid lifestyle inflation

Lifestyle inflation refers to an increase in spending when your income rises. The increased spending that results from lifestyle inflation can quickly become a habit; the more you earn, the more you burn. You buy more expensive things than you need just to maintain your new standard of living.

Instead of upgrading your lifestyle every time your income increases, set and stick to the financial goals that will help you increase your financial wellbeing and happiness in the long term.

While it’s good to occasionally treat yourself, being mindful of the differences between needs and wants can help you manage lifestyle inflation before it ends up managing you.

6. Stop comparing

Hedonic adaptation also applies to how we adapt to the situations of those around us. When people close to us have things we desire, the constant comparison can make it harder for us to adjust to what we have. This can slow down our own adaptation process.

Here’s an example: Imagine you really want a specific car, but it’s outside your budget. You choose a more affordable option, and over time, you get used to it and enjoy it. However, if your neighbour then buys the car you originally desired, the daily comparison between your vehicles can hinder your adaptation and decrease your happiness.

The book “The Upside of Irrationality” suggests that unfortunately, our happiness can be influenced by keeping up with those around us. However, you have the power to recognise this and choose how much it affects you. You also have some control over the social environment you surround yourself with.

Related: 7 limiting money beliefs that prevent financial success

Conclusion

In our pursuit of happiness, how we manage our money can be a big deal. Hedonic adaptation, the tendency to return to a baseline level of happiness despite life circumstances, can significantly impact how we approach personal finance. This concept explains why that bonus or dream purchase might not bring lasting joy, and why expensive items quickly lose their thrill.

The good news? Understanding hedonic adaptation can make us smarter with our money and increase our levels of happiness. Instead of buying things that give us a short-term high, we can focus on experiences that create lasting memories and things that truly matter to us. These are the things that contribute more to long-term happiness than the fleeting joy from new things.

And remember, real wealth is about more than just money. It’s about living a fulfilling life filled with experiences, strong relationships, and doing what matters most to you. By making smart financial choices that bring lasting happiness and keep your finances secure, you can take control and create a life that brings you joy.

Related: Lifestyle financial planning: How to build your DIY plan