Buy now, pay later (BNPL) schemes have quickly become a popular payment option for consumers in the UK. BNPL services and credit cards have some similarities but have unique pros and cons too.

In this article, we explain how BNPL services work and explore how they compare with credit cards.

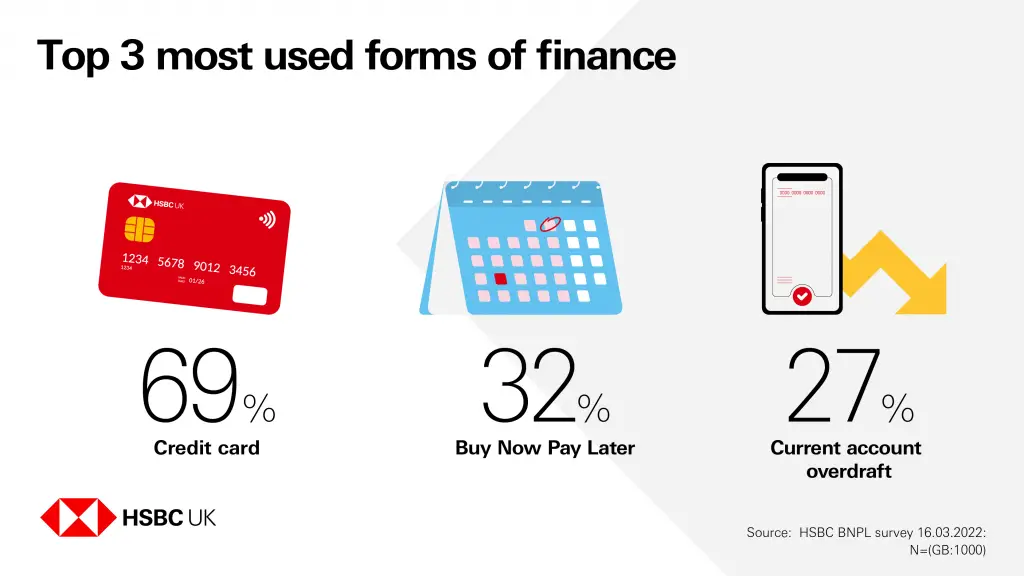

Sponsored content: We are working with HSBC to compare Buy Now, Pay Later vs Credit Card. Unless otherwise stated, all figures are from an HSBC UK survey.

What is Buy Now, Pay Later?

As the name suggests, Buy Now, Pay Later (BNPL) is a way of buying things on credit and paying for them later. It allows you to spread the cost of a purchase interest-free. You can often see it offered as a payment option when shopping online. The most popular BNPL brands in the UK include Klarna and Clearpay.

Research from HSBC shows that Buy Now, Pay Later is the second most-used form of finance behind credit cards. In fact, 32% of consumers in Britain use this payment method.

There are various payment options with BNPL. These include paying an invoice within 30 days, spreading the cost of a transaction into interest-free monthly instalments or splitting payments across a number of months with added interest.

But similar to a credit card, if you don’t clear the bill during the interest-free period, you will be charged interest on the outstanding balance.

If you are deciding which one is better for you, Buy Now, Pay Later vs credit card, let’s look at the pros and cons of each option.

Pros: Buy Now, Pay Later vs. Credit Card

- You can buy goods instantly and pay for them later with no interest.

- Allows you to spread the cost of your purchases.

- Customers shopping online have an option to “try before you buy”.

- Can be accessed easier than credit cards as providers don’t carry out hard searches.

- Allows you to spread the cost of larger purchases.

- Easy and convenient to use because credit cards are accepted by most sellers.

- Some credit cards offer a 0% interest period. That means you can borrow interest-free as long as you make your minimum monthly repayments.

- Specialist credit cards can help you earn rewards, air miles or cashback on your spending.

- Your purchases are protected under Section 75 of the Consumer Credit Act.

- You can boost your credit score if you make repayments on time.

Cons: Buy Now, Pay Later vs. Credit Card

Cons of Buy Now, Pay Later:

- It can be easy to spend money you don’t have and your debt may quickly spiral if you’re not careful. 60% of BNPL users say that one of the top drawbacks is that it’s too easy to get into debt or overspend.

- BNPL services are only available on selected retailers.

- You can only use the BNPL provider offered by the retailer you are shopping with.

- You may face large charges if you miss repayments or make late ones.

- Missed or late payments will hurt your credit score.

- BNPL is not currently regulated by the Financial Conduct Authority (FCA) (although this is set to change in 2023) so your purchases aren’t protected under Section 75 of the Consumer Credit Act.

- Ease of access makes it easy to spend money you don’t have.

- If you don’t pay your bill in full every month, your debts can pile up quickly.

- It can take a long time to pay off your credit card debt if you only make the minimum repayment.

- You will be charged a fee for missed or late payments, which will have a negative impact on your credit score.

- Some credit cards might have a monthly or annual fee, and many balance transfer cards charge a fee to switch a balance.

Which one should I choose?

Which option works best for you will ultimately depend on your personal circumstances.

BNPL can offer you interest-free borrowing and allow you to spread the cost of purchases over a couple of months. This is also possible with most credit cards but often up to 56 days.

With BNPL services, you can access credit quicker at the point of sale if you don’t already have a credit card. However, this also encourages shoppers to make impulse purchases they cannot afford.

It’s also important to remember the benefit of Section 75 on credit card purchases between £100 and £30,000. This cover isn’t available for BNPL services at the moment. The bigger your purchase is, the more important the access to this benefit can be.

Both options can hit your finances and hurt your credit score if you don’t stay on top of repayments. Whether you chose Buy Now, Pay Later or a credit card, make sure you use your debt responsible. As a rule of thumb, don’t buy something you cannot afford and always pay your bill in full when it’s due.