Tiktok does it. YouTube does it. Netflix does it. Talk about money, that is. But in the age of instant information, why isn’t personal finance taught in schools? Why doesn’t society encourage us to explore investing, alternative career paths and the importance of multiple income streams?

With new technology and social media channels entering our lives and tempting us into spending more than we should – or even making high-risk investment moves – I began thinking about why is there still no focused effort being put towards teaching kids how money works.

In fact, I created this blog because of this specific reason: lack of financial literacy and money education in schools – and in our society in general. Therefore, in this article, I’ll be exploring the reasons why personal finance isn’t taught in school and what we can do about it.

The current state of financial education in schools

Honestly, I was surprised to find out that the national curriculum in England has actually had some finance studies included under citizenship education since 2014. According to the Department for Education, the curriculum should:

- Enable all pupils to manage their money on a day-to-day basis, and plan for future financial needs.

- Teach about the functions and uses of money, the importance and practice of budgeting, and managing risk.

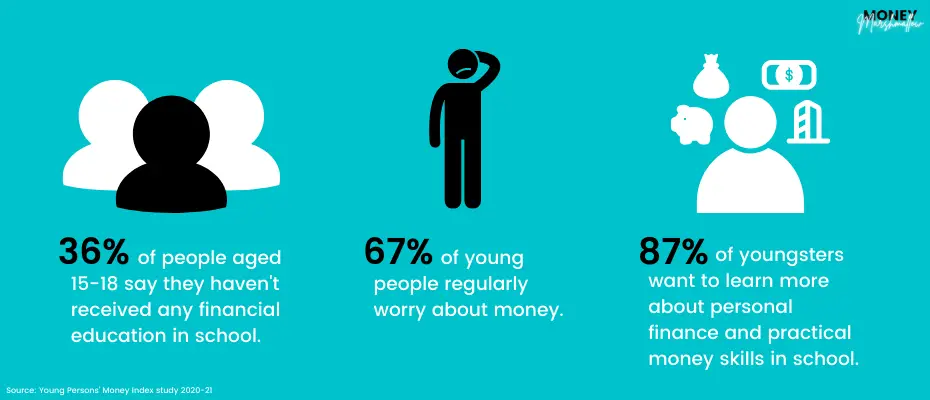

Despite the curriculum, The Young Persons’ Money Index study 2020-21 reveals some intriguing facts about money and personal finance education:

- More than a third of people aged 15-18 say they haven’t received any financial education in school.

- As many as 67% of young people say they regularly worry about money.

- The vast majority of youngsters (83%) actually want to learn more about personal finance and practical money skills in school.

With the above in mind, it doesn’t come as a surprise that years after finance education was added to the curriculum, the UK is still below average at teaching financial literacy.

If you ask me, these numbers speak for themselves. So why is it that there still isn’t sufficient personal finance education in schools?

Why is personal finance education important?

Personal debt is at an all-time high, pension pots are falling behind and the number of people investing in ISAs is falling.

With rising house and rent prices, bigger university debts and slow wage growth compared to inflation, many are struggling to save money. In fact, a third of Brits have less than £600 in savings while 1 in 10 has no savings at all.

However, this could be turned around if greater significance was placed on personal finance education in schools. Today’s students need to gain financial confidence and money management skills to build a sustainable future for themselves.

Even short-term decisions, such as choosing a mobile phone plan or home insurance provider, require a level of financial understanding. Add to that a need to prepare the young generations for buying a house or planning for retirement. With this said, it’s clear that financial literacy has its place in the classroom.

Reasons why personal finance isn't taught in school

Despite finance education being part of the curriculum, young people are still lacking practical knowledge of money management. Let’s dive into some details that might help us find some answers.

1. Money is still a taboo

In many Western cultures, money is seen as a taboo topic. As children, we’re quietly taught to never discuss our personal finances.

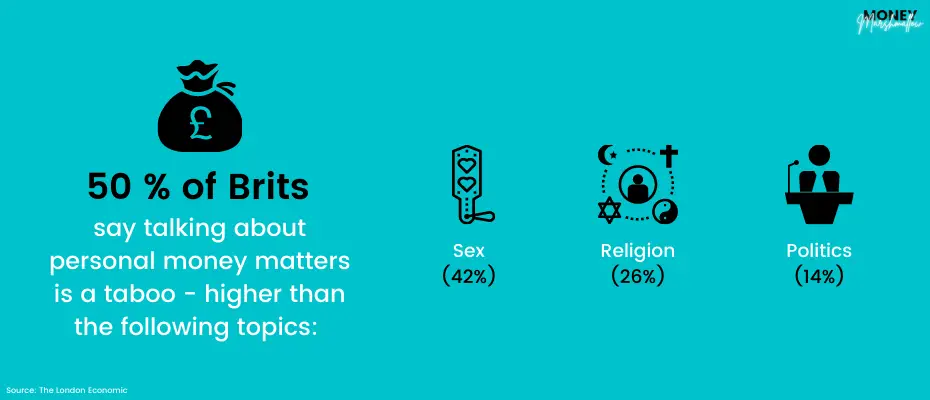

Research from 2019 shows that half of Brits say talking about personal money matters is taboo in everyday conversation. Interestingly, this is more people that find sex (42%), religion (26%) and politics (14%) a taboo topic!

The study also found that a quarter of people in the UK have lied to family and friends about their personal finances. And 23% have fibbed to their partner about money in general, leading to 37% having arguments about their finances.

How can we possibly move forward with finance education if nobody feels comfortable talking about money?

2. Teachers lack financial literacy

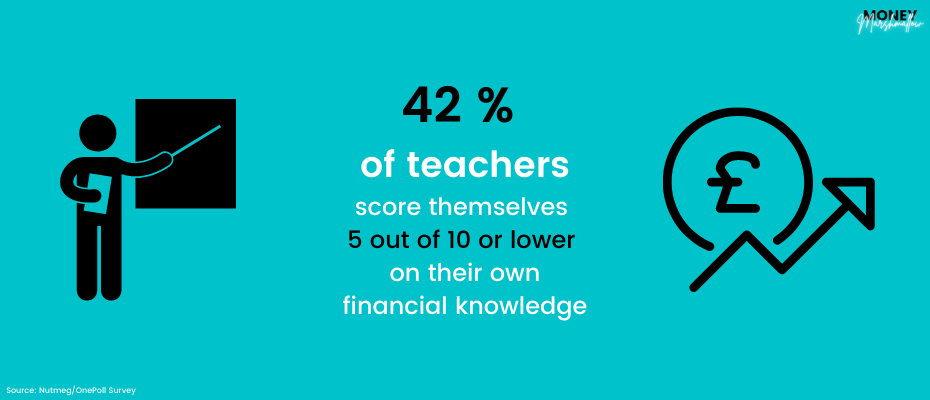

Although financial education has been part of the curriculum since 2014, the government has put no resources into teaching it. Therefore, it’s no surprise that only around 40% of schools actually provide some form of money education. The reason behind this baffling issue may be partially because of teachers’ under-confidence.

According to a study by an investment platform Nutmeg, teachers don’t feel confident in their own level of financial knowledge. Shockingly, almost half of teachers score themselves at 5 out of 10 or lower when it comes to money knowledge! This certainly helps us paint a picture of why personal finance isn’t taught enough in school!

We wouldn’t have teachers teaching French or Spanish who don’t speak the language themselves so how do we expect teachers with a lack of financial literacy to teach about money?

This said, the education system has to step in and offer education to the teachers first. Not only do they have to educate teachers on personal finance, but they also have to help them improve their own financial situation. Only then we can expect to pass this knowledge to children.

3. Parents aren't fluent in money matters

So if schools don’t teach enough personal finance matters, where do kids learn about money then?

Going back to The Young Persons’ Money Index study, a whopping 75% of youngsters say that most of their financial understanding and knowledge comes from their parents. This can of course be great if your parents are savvy with money – but what if they’re not?

The financial education kids receive at home can depend massively on their family background. For example, children of entrepreneurial parents with property wealth would learn very different things about money compared to children whose parents are in a constant debt cycle. When a parent makes bad choices with finances or has debt problems themselves, these money habits tend to transfer over to their kids as well.

Finally, many parents even find it daunting to talk about money with their partner. So regardless of parents’ financial situation, if they find money a taboo and a difficult topic to discuss, how can they teach their kids about the topic?

While parents’ role in personal finance education unarguably remains important, it’s the education system’s responsibility to provide equal learning opportunities to all children.

4. The system is lagging behind

What I mean by this is that times have massively changed but society is struggling to keep up with it. And the education system is no exception.

I’m sure you’re familiar with the “good” old life advice that goes something like: Study hard, get good grades and find a high-salary job. Stay with the company for 40+ years and in exchange, they’ll pay you a generous pension.

This might have worked for the past generations but we Millennials or Gen Zers are not buying this. According to a Future Workplace study, 91% of Millennials expect to stay in a job for three years or less. Money is not the first or even the second, priority for many. Instead, 20 and 30-somethings equate job satisfaction with good benefits and doing what they love. In addition to 9-5 jobs, side hustles and exploring financial freedom have become more common among these generations.

In addition to the mindset change, there have also been various practical changes when it comes to money and career. The pension, tax and legal systems have changed drastically in the past couple of decades. This means you’re now responsible for your own retirement savings and finances.

Schools are still teaching us the whole ‘get good grades and a high-paying job’ shabang – but that’s not enough anymore. If you want a secure retirement and a financially stable life, a university education or a fancy job isn’t going to be the answer alone. Financial literacy is what you need for today’s world – powerful information on how to grow wealth has never been more important than now! Unfortunately, society hasn’t caught up on this yet.

What can we do to push money education forward?

Regardless of finance now being a part of the curriculum, students don’t feel school supports them enough when it comes to personal finance education. This highlights that the current solution to financial education still isn’t having the required impact.

We now understand some reasons why personal finance isn’t taught enough in school. But how can we improve things? And whose responsibility is it to teach kids about money?

In order for drastic progress to be made in the educational system, all members of society need to take action: the government, teachers, parents and students themselves. It starts with each individual being willing not only to take responsibility but also to share their voice so they can help shape a better future together.

Understandably, changes like this don’t happen overnight. However, there’s something we can all start doing today to help: talk more about money. Normalising conversations about money can help us make better financial decisions and improve our relationship with money. Long-term, this can help children and the younger generations to form good lifetime money habits.

Honestly, I don’t think it has to do with the system “lagging behind” but more a system designed to retain the status quo. That life advice is not something I ever heard growing up in a low income family. Agree that financial literacy should be taught in schools and that many teachers and educators don’t even have the knowledge. It is a shame that it isn’t, especially for people who are stuck in the cycle of poverty. My school focused more on extracurriculars for girls like home ec, making quilts and planning a wedding than teaching more important life skills like investing and home ownership and because of it I was behind some of my counterparts for awhile. Luckily I found resources as an adult but It’s still a learning experience.

curatingstories.com

Thanks for your comment Shala, I really appreciate your view on this! It can certainly be difficult to start learning about these things and changing your money mindset and habits as an adult. This is exactly why it would be so important to teach personal finance in school and provide all children equal learning opportunities regardless their background.

This is all so true! And sad. Financial literacy should be a constant learning topic at school, not a once and done (if that) to make sure it is funny understood and so that it can be implemented in life. If everyone was financially literate we would live in a completely different society, one that is much better. Thanks!

Absolutely right, thanks for your comment Katherine! It’s a shame how little they teach about essential life skills (including money) in school.

100%! When I left school and left home shortly after turning 16 with my son, I was left in a right hole. I had no idea how to manage my money, I ended up in debt because I was being offered credit all over the place and why would I say no? I had no idea of the damage it would cause me for the next 20 years of my life! The only experience I had from my mother was she ran up debt in all the worst places, constantly hiding us when someone knocked the door and eventually declaring herself bankrupt. She lived in a council house, chose not to work and never had any aspirations of ever being anything other than what she was. It’s only now at 36 years old I have finally come out of the other end and am getting my life (and finances!) back in order. I have made sure that I have always talked to my children about money, where credit is a positive thing and where it most definitely is not, the savings vs paying debt debate and not putting all your eggs in one basket so to speak with your income. After experiencing bailiffs, nearly losing my house and being taken advantage of from lenders who clearly target those who are vulnerable I don’t ever want any of them to have to go through what I did. Great read thank you!

Thank you so much for your comment Christine and for sharing your personal experience! Glad to hear you have managed to get your finances back in order after all you’ve been through! It’s also fantastic that you talk to your children about money so openly – I’m sure they will appreciate it when they are grown ups and will have to manage their own money! 🙂

Such a valid discussion. We as adults spend most of our time earning, discussing, saving and budgeting money so why the basics of personal finance aren’t taught in school seems a bit of a mystery. Especially considering we now live in a society where you can sign up for a credit card online in minutes!

Absolutely, it’s so easy to get it wrong with money if you don’t know what you’re doing – and can take years to get yourself back on track when doing one mistake, such as taking lots of debt when you can afford to pay it back.

What an important discussion to have, my son hated school, he has done really well despite that but he has always said more useful stuff should be taught. Michelle

Exactly, it seems that teaching actual life skills, such as money management, have been left as parents’ responsibility. It can be tricky if parents are not so good at it themselves.

While it is certainly something that would be useful to be taught in schools, the onus should not be entirely on teachers who already have an enormous list of extras on top of their subject specialisms. There may be some changes forthcoming as a result of the change in career education perhaps.

Very valid point. Changes like this need contribution from all members of society, not just teachers 🙂 I believe we need to normalise money conversations in general before any big changes can happen.

I WISH I had been taught more about the practical aspects of managing personal finances. I got a credit card when I went to college and quickly learned what debt is… I think it’s important that finances are included in curriculum, especially at the high school level.

Exactly – it’s a shame how many people only learn about personal finance by making their own mistakes first.

Great blog! It’s more important than ever for kids to learn about money.

One of the best ways for parents to start talking to their kids about money is by getting them to think of money like seeds. If they plant (save / invest), they will grow into trees. Their job is to grow a financial forest. This visualisation can really help kids learn about saving and form a savings habit.

‘Our kids money habits will determine their future financial wellbeing’

Thanks, Will! That’s a great tip and visualisation exercise 🙂

A very insightful article! I appreciate the use of statistics and the infographics are great too.

Things are definitely changing, even if it is happening slowly. I’m glad that the internet grants us access to so many resources on this topic.

My wife and I talk money all the time and it’s helped us overcome a lot of initial financial difficulty in our marriage. When our kids are old enough we will definitely be making sure they know about and can talk about money!

Thanks for sharing your insights and hopefully the pace of change will start to quicken.

Thank you, glad you enjoyed it! The Internet has definitely opened up opportunities to educate ourselves more about money. At the same time, it can be challenging for those who are less educated as there’s unfortunately lots of misinformation and ‘spend traps’ too. But let’s hope things get better in terms of personal finance education little by little 🙂

With you in this. Also the benefits of compounding works wonders when you start young.

100%, there are so many things we should learn about money (including the power of compounding) when growing up that would help us be financially successful long-term and avoid money mistakes.