In today’s digital age, online games have become more than just a source of entertainment for kids. Thanks to the rise of educational gaming, children now have an exciting opportunity to learn valuable life skills while having fun.

In this article, we will discuss the importance of teaching kids about money and how educational money games play a crucial role in fostering financial literacy from an early age. We will also explore some educational online games that teach kids about money and savvy financial choices.

The importance of teaching kids about money

Teaching kids about money is an essential aspect of their overall education. Money is an integral part of our lives, and understanding its value and management is crucial for kids’ future financial well-being. By introducing financial concepts at a young age, children can develop healthy money habits and make informed decisions as they grow older. Here are some key reasons why teaching kids about money is so important:

Building strong financial foundations: Early financial education lays the groundwork for responsible money management in adulthood. Children who receive financial guidance from parents or through educational programs are better equipped to handle their finances responsibly later in life.

Instilling good money habits: By teaching kids about budgeting, saving, and the value of money, parents and educators can help instil good money habits from an early age. These habits can lead to a lifetime of smart financial choices.

Empowering decision-making skills: It is important for children to understand the consequences of financial decisions. Learning about money helps kids develop critical thinking and decision-making skills as they evaluate trade-offs between spending, saving and even investing.

Navigating a complex financial world: In today’s complex financial landscape, it’s essential for children to be financially literate. Knowledge of money management and common personal finance and economics terms will better prepare them for their financial future.

How games can help kids to learn about money

Educational games that teach kids about money offer a creative and engaging way to introduce financial concepts to kids. These games combine entertainment with learning, making the process enjoyable and effective. Here’s how educational money games play a significant role in teaching kids about money:

- Gamified learning: By incorporating elements of gamification, money games capture children’s attention and maintain their interest. The challenges, rewards, and progression in these games keep kids engaged and motivated to continue learning. In fact, a University of Cambridge research shows that with the use of games, children of all ages have better engagement, participation, achievement and recall of their learning.

-

Hands-on practice: Unlike traditional teaching methods, money games offer hands-on practice with financial concepts. Children can actively manage budgets, make transactions, and understand the consequences of their financial choices.

-

Practical application of skills: Educational money games bridge the gap between theory and practice. Kids can apply the knowledge they gain from the games to real-life situations. For example, saving their allowance or deciding on how to best spend it. Moreover, parents can enhance the learning experience by discussing the financial concepts depicted in the games with their children. By engaging in these discussions, kids gain a deeper understanding of money management and financial decision-making. In addition to games, money management apps like HyperJar can also provide kids with hands-on practice with financial concepts.

6 online games that teach kids about money

This section explores six online games designed to teach kids about money in an engaging way. From math challenges to property investment quests, these games inspire financial empowerment in young players. While these games provide fun for kids, the key is to support them in learning the valuable money lessons embedded in the games.

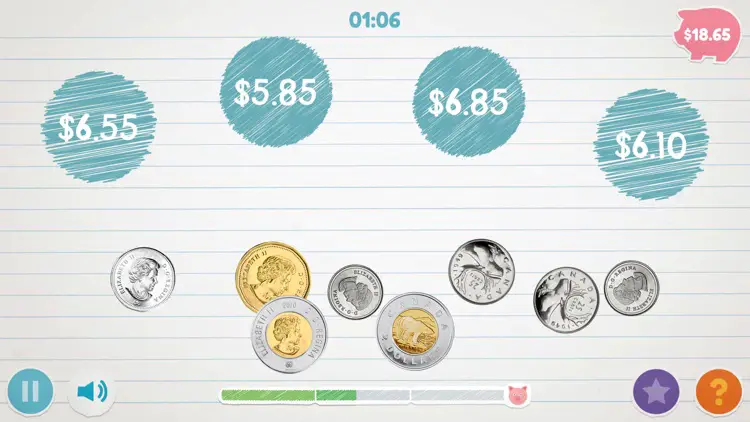

1. Peter Pig's Money Counter (Ages 5-8)

Peter Pig’s Money Counter is an educational game app available for free on Apple and Android app stores. It is suitable for kids aged 5 to 8, and is designed by Visa to teach young children money recognition and counting skills. In this interactive game, kids assist Peter Pig in sorting and counting coins, making the learning process fun and engaging. By handling virtual coins and understanding their values, kids develop foundational financial knowledge while building essential math skills. Peter Pig’s Money Counter provides a playful introduction to money concepts, fostering financial literacy from a young age.

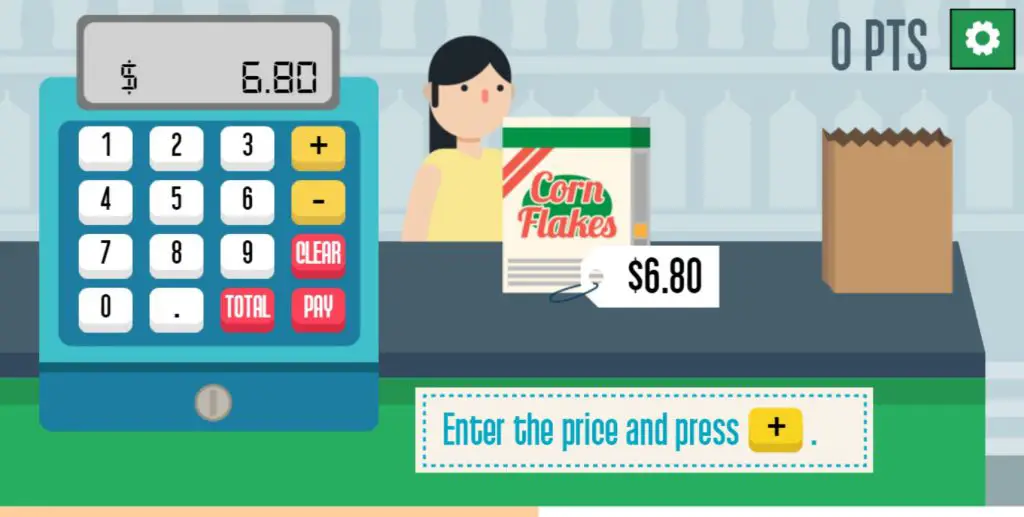

2. Grocery Cashier (Ages 5-8)

Grocery Cashier is an online game that teaches kids about money by helping them to practice math skills in a fun way. As virtual cashiers, players sharpen their addition and subtraction abilities by handling transactions at the cash register. Each customer represents a new level, challenging players to ring up items and calculate totals. Whether handling payments with gift certificates or money, kids can improve their ability to calculate and provide accurate change. Grocery Cashier turns everyday grocery transactions into an exciting adventure, making math and money management enjoyable for young learners.

3. Real Estate Tycoon (Ages 6-9)

Real Estate Tycoon is an engaging game that introduces kids to the world of property investing. Players strategically buy and sell real estate holdings that briefly appear on the map. From small houses to large commercial buildings, each property comes with its own challenges and potential profits. As players progress, they can switch to larger and more valuable properties, experiencing higher appreciation rates but also faster value declines. The goal is to capitalise on the price difference by purchasing low and selling high.

This game offers a very simplified and kid-friendly approach, avoiding intricate real estate market details. Yet, it provides an engaging platform for children to explore basic property concepts with enthusiasm and curiosity. Interactive gameplay teaches valuable lessons about the property market and decision-making, as kids navigate fluctuating prices to maximise earnings.

4. Island Saver (Ages 7-12)

Island Saver is an educational video game that empower children with valuable financial literacy skills while also promoting a positive environmental message. Developed by NatWest and the MoneySense program, it is available available on various games consoles as well as app stores for mobile.

In this imaginative gaming world, children will embark on thrilling adventures to clean up the once tropical paradise of the Savvy Islands, which has been overrun by gloop and plastic pollution. Through interactive gameplay, kids will encounter various “money missions”. They can earn virtual coins, feed the islands’ adorable animals, trade goods, and learn about managing needs and wants. Even tax and foreign exchange rates become part of the learning journey.

Island Saver strives to create an enjoyable family-friendly game with essential financial education. Alongside the game, activity sheets are provided to engage and guide your child through important money questions. Island Saver aims to increase financial confidence from an early age, equipping children with crucial life skills, including sustainable financial choices.

5. Monopoly Go! (Ages 8+)

Monopoly Go, the mobile version of the iconic board game, provides an exciting and educational experience for kids. With over 100 game boards and iconic tokens, children can develop strategic thinking, entrepreneurship, and financial skills while building their real estate empires.

In Monopoly Go, players engage in dynamic gameplay, navigating property pricing, banking, taxes, and fines across various game boards. The interactive Chance and Community Chest cards introduce real-life financial scenarios, highlighting money management skills and the importance of wise decision-making.

With social and competitive aspects, kids can interact with players worldwide, enhancing the learning journey. Suitable for ages 8 and above, Monopoly Go offers a fun and educational path for kids to gain practical knowledge about money.

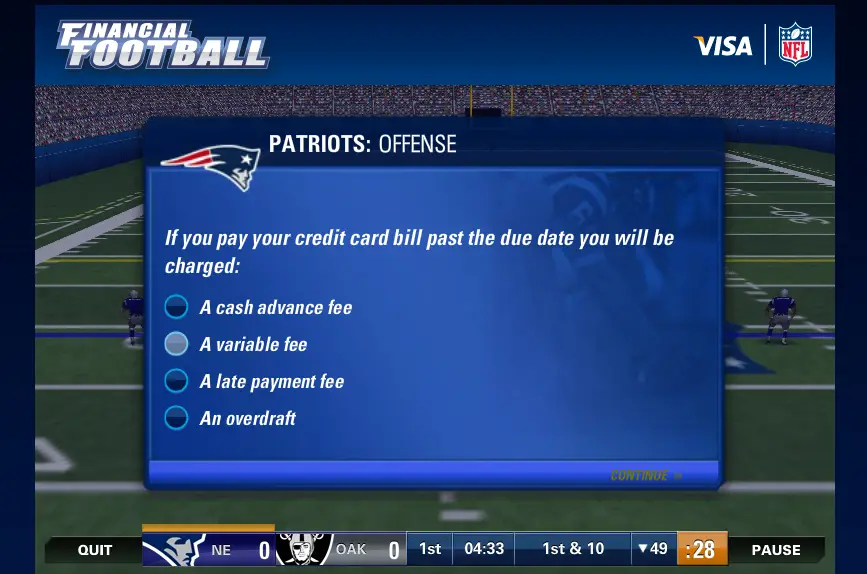

6. Financial Football (Ages 11+)

Financial Football is an educational money game developed by Visa and the NFL. It offers a unique and interactive approach to teaching kids about money. By combining the excitement of (American) football with financial literacy lessons, it engages young players in a fun and relatable learning experience.

In the game, kids choose their favorite NFL teams and progress through different difficulty levels by answering financial literacy questions. The game covers topics like budgeting, saving, credit, and investing. Correct answers help them gain yardage, while incorrect ones set them back.

The real-life relevance of the questions allows kids to grasp practical applications of financial concepts, empowering them to make informed money decisions. Suitable for ages 11 and above, Financial Football effectively promotes financial literacy and fosters money management skills in a sports-themed, engaging manner.

Conclusion

Educational games serve as great tools for teaching kids about money. These dynamic games effectively introduce financial concepts in an enjoyable manner. However, the true power lies in the supportive role of parents and educators. They can complement these games by engaging in discussions, real-life experiences, and practical applications.

By combining online money games with open conversations about money management, involving kids in real financial decisions, and encouraging hands-on experiences like budgeting and saving, we can nurture financially savvy individuals. This multifaceted approach ensures children develop a strong foundation in financial literacy, empowering them to navigate the complexities of the modern financial world with confidence.

I love this blog! I’m a teacher and I love finding ways to incorporate technology into my lessons. This is a great idea!