The property market presents one of the most popular investment prospects – but how to make money from property? Do I need a lot of money to invest in property? Good news: no, not necessarily.

Most people think a property investor is always a landlord who buys properties and rents them to tenants. And because this strategy can require quite a lot of initial investment, many people think they can’t invest in property. However, in reality, that’s not the case!

While the strategy of buying and letting is one of the most common ways to approach property investing, it’s far from being the only investment strategy available. In fact, there are various different property strategies that all require different levels of money and time invested. You’ll be pleased to know that there is a suitable way to make money from property even with little to no money.

In this guide, we look at nine different strategies for making money from property and discuss some pros and cons of each of them. Let’s break it all down below.

Buy-to-Let (Rental Income)

Buy-to-let is one of the most popular methods for making money from property in the UK. It’s a common strategy because it’s a simple way to generate passive income. The process of traditional buy-to-let is very straightforward. You purchase a property either outright or with a mortgage and rent it out to tenants in order to generate rental income. This could either be a student or residential property, or commercial property.

Buy-to-let can be a great way to generate monthly income but it usually needs a significant initial investment. Although you don’t need to buy a property outright with cash, buy-to-let mortgage lenders usually require a minimum deposit of 25%. This is significantly more than residential mortgage deposits that typically start from 10%.

As with any investment, thorough research is needed when buying a rental property. Here are a few things to consider if you want to make money from buy-to-let property:

- Rental yields can differ hugely depending on the area you invest in. Do your research and aim to find an area where house prices are low in relation to rental prices. In short, buy low and rent high.

- You can be as involved or as hands-off as you like. If you are happy to find tenants and manage the property, you can increase your profit margin. Alternately, if you prefer the income to be as passive as possible, you can outsource everything from finding tenants to maintenance to a letting agent.

- In addition to the monthly mortgage payments, take into account other costs such as insurance, letting agent fees (unless you self-manage) and maintenance costs when doing the due diligence.

Capital Appreciation

Capital appreciation refers to a rise in a property’s market value. It’s the difference between the purchase price and the selling price of an investment.

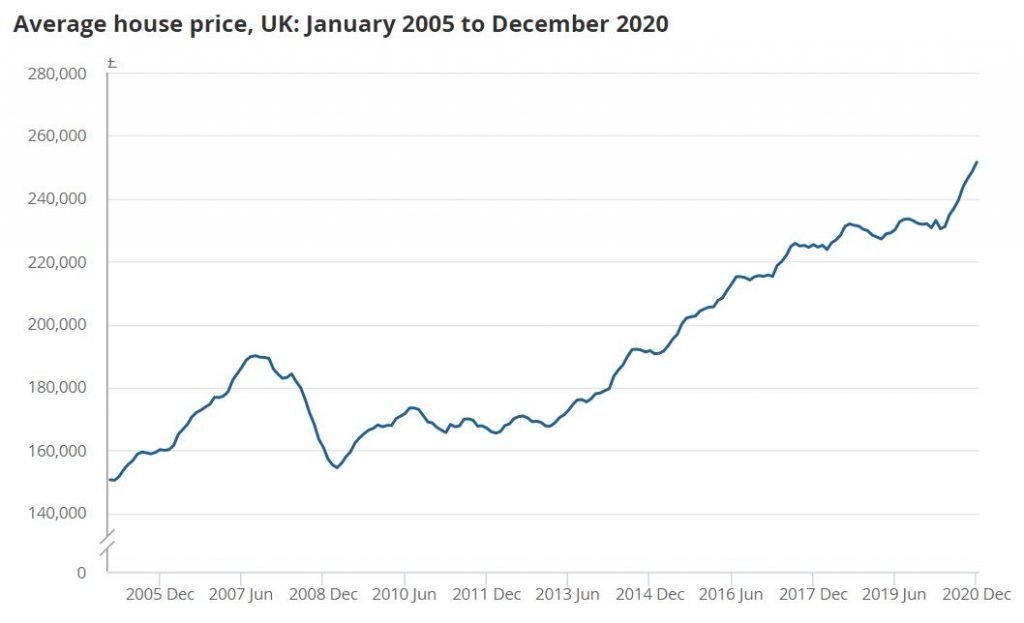

According to the UK House Price Index, the average house price has gone from £168,703 in 2010 to £251,500 in 2020 (see graph below). In other words, this is a 67% increase in 10 years! Because UK property has a strong history of growing house prices, many property investors follow a long-term strategy whereby they buy and hold. Capital growth is the amount of money then they make when selling the investment property after 10 or 20 years, for example. The benefit of capital appreciation is that the gains generally happen without you needing to do much. However, you can also increase property value with refurbishments to the property.

The capital appreciation strategy can surely be a great way to make money from property long-term, especially in areas where prices are rising rapidly. However, this strategy is best to be combined with regular cash flow from rental income to make money from property investing short-term too.

Serviced Accommodation (Short-term lets)

Serviced Accommodation strategy works like buy to let, however, instead of renting a property for long-term tenants, you rent it out short-term. Short-lets like this are very popular among tourists and business travellers as they offer a more cost-effective and convenient solution to hotels. Thanks to the rise of Airbnb, Booking.com and other holiday let websites, it’s now very easy for homeowners or investors to rent out their properties for a couple of days, weeks or months at a time. Further to this, short-lets are an increasingly popular strategy to make money from property due to rental yields being significantly higher compared to the typical monthly rent.

However, serviced accommodations also tend to require much more management than long-term rentals. This is because there is a much higher turnover of guests, meaning more cleaning, maintenance and guest communication. Similar to long-term rentals, you can either do all this yourself or outsource some or all the work to a co-host or an external company. Most short-let hosts hire at least a cleaning company to manage the cleaning and linen hire. There are also various short-let/Airbnb management companies that can take over the other hosting elements, such as guest communication and maintenance, too.

If you are intrigued by the idea of holiday lets but don’t own a property, don’t worry! Find out how to make money on Airbnb without owning property.

It’s also worth noting that there are some significant tax differences for individuals that can make short-lets beneficial over long-lets. While you get taxed from usual rental income as an individual, services accommodation is classified as a business. This on the other hand allows you to tax-deduct more costs, including mortgage interest and service charges.

Rent-to-Rent

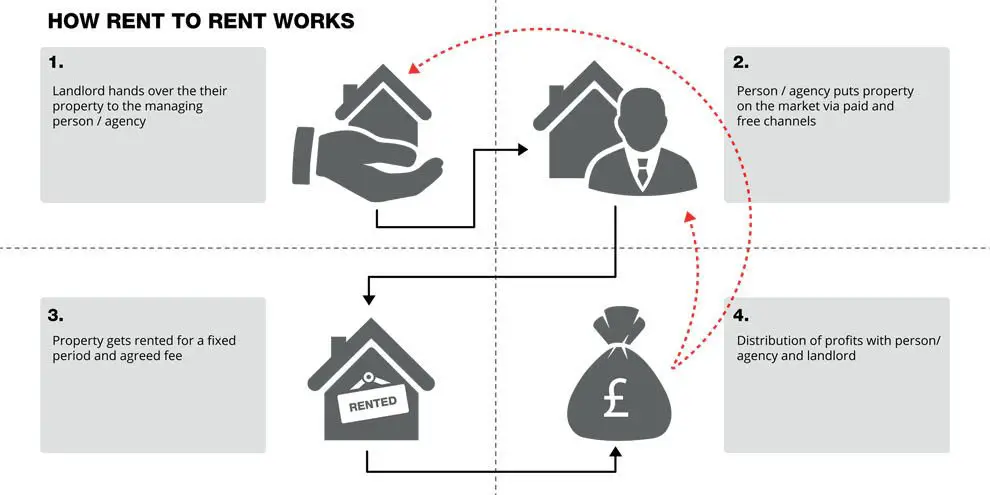

Although rent-to-rent is not a property investment strategy as such, it can be a fantastic way to make money from property. This is a great strategy, especially for those who want to get involved with real estate but don’t necessarily have much money to invest. But what does rent to rent actually mean?

As the name suggests, you rent a property from a landlord to rent it out to tenants or short-term guests yourself. You, therefore, take control of the property and act as a landlord – just like you would if you owned the property yourself. While subletting on a normal tenancy agreement is not usually allowed, this form of subletting is perfectly legal and usually involves commercial or corporate tenancies or management agreements.

There are a couple of things to consider in order to make rent-to-rent a win-win both for you and the landlord:

- You will give the landlord a fixed guaranteed rent for a set amount of time – usually at least a couple of years. The landlord is happy because they have a guaranteed income long-term, without any of the efforts or maintenance that renting out a property normally involves.

- The rent you pay to the landlord will be lower than you’ll be able to charge to your tenants or guests. This way you’ll be making a profit – which is basically your reward for taking on the effort of managing the property. To make more money than you pay the landlord for rent, you can rent the property as an HMO or serviced accommodation. You can also decorate and furnish is to further increase the rental value, and eventually, your profits.

Why is rent to rent a good way to make money from property for beginners?

Taking control of a property naturally comes with responsibilities and tasks that can be time-consuming. These include tasks such as finding and dealing with tenants, meeting regulatory standards and conducting maintenance. However, if you are happy to do the work and keen to get into property without a big initial investment, rent to rent has some clear advantages compared to many other property strategies, including the following:

- No mortgage: You get to earn income from property without buying one or having to afford a mortgage.

- No deposit: If you buy a property to let, you need an average deposit of 25%. However, with rent to rent, your start-up costs will usually only be the rental deposit and decorating or furniture costs.

- No legal expenses or stamp duty: since you are not purchasing the property, you don’t pay the usual transactional costs that come with buying a property, such as conveyancing fee or stamp duty.

- If you want to eventually become a property owner, you can save your profits towards a deposit and other fees.

Lease Option Agreement

Similar to rent-to-rent, a lease option can be a great money-making strategy for those without much money to invest. In short, a lease option is an agreement that allows you to take control of a property and make income from it. However, as opposed to rent-to-rent, a lease option agreement also gives you the right (but not the obligation) to buy the property later. The fixed term for the agreement can be anything both you and the landlord are happy with. That said, typically lease agreements are around 3-5 years.

The beauty of this strategy is that it doesn’t just allow you to make a monthly income from the property but also gives you the option to buy it later for an already agreed price. And why is this great then?

As discussed earlier in this article, house prices in the UK tend to increase every year. Therefore, if the value of the property goes up above the agreed purchase price, you can buy it and have equity straight away. Alternatively, if it doesn’t go up, you can just hand the property back – and still make money from the property in the meantime!

How to find lease option opportunities?

Property owners that might be interested in a lease option are usually owners that will need to move houses quickly but are in negative equity. This means that they own more money on their mortgage than their house is currently worth. Therefore, to find these opportunities, you’d be looking for someone in negative equity who needs to move because so of the following reasons, for example:

- They need to relocate for work

- Their family has grown and they need a bigger property

- They can’t pay the mortgage

- They’re getting divorced

Buy, Refurbish, Refinance, Rent (BRRR)

As covered above, rental income is many property investors’ favourite source of passive income. But if you want to maximise your property investments, you’ll have to get a little less passive and get your hands dirty (not necessarily literally). Let’s cover BRRR strategy below step by step.

- Buy: The first step is to buy undervalued property. In the BRRR strategy, the property is often purchased with cash, a bridging loan or an angel investor. The most common reason for a property to be sold below the market value is because it needs some work. In general, the worse condition the property is in, the more value you can add to it. If that’s the case, it brings us to the next step.

- Refurbish: Once you’ve found a house bargain, identify how to make it liveable and functional. Once these requirements are met, consider updates or renovations that will add value to a property (and therefore justify increased rental rates).

- Refinance: When you have completed the refurb, get a surveyor to value the property. The property should have increased in value enough to pull all your initial money back out through refinancing. Essentially, this means that you mortgage a house that you already own. Therefore, you should now have your initial investment and some additional profit back from the mortgage lender.

- Rent: Finally, you rent out the newly refurbished property, through which the rental income can enable you to pay the mortgage, earn profits and build up equity over time.

Flipping

Also referred to as property trading or buy to sell, flipping means buying a property at a low price and then selling at a higher price to make a profit. In order to do this, there needs to be a reason to justify selling the property at a higher price. Similar to the BRRR strategy, refurbishing the property is typically part of the flip process to increase the property value.

However, opposite to BRRR, you don’t rent the property after fixing it. Instead, you will sell it as soon as possible after the refurb is done. Flipping can therefore be a fantastic way to make money from property in a short space of time.

Top tips for a successful house flip

- Do your due diligence: Juggle the numbers to make a realistic projection of a property’s potential value and whether that can be achieved cost-effectively. Keep in mind the buying price and the various ongoing refurbishment costs.

- Understand your potential buyers: Think about who you plan to sell the property to, e.g. families, couples or buy to let investors. Each of these buyers might want something different

from their home so keep this in mind when refurbishing the house. - Stage your property: Properties that are home staged tend to sell faster and for a higher price. In short, home staging is dressing a house to sell by making it look as appealing as possible. Some ways to do this include furnishing, small decorative items or plants.

- Promote the best parts of the property: Emphasising the best aspects and details of your property online is essential – especially now that many estate agents offer virtual viewings. Ensure all rooms and features look appealing and homely. Professional photos also tend to make a massive difference and help you attract more attention.

Deal Sourcing

Deal sourcing is a great way to make extra income from property without owning any yourself. This is also a perfect strategy for beginners with little or no money to start with. Deal sourcing and packaging can help you to get started generating cash flow. Sounds good? So what is deal sourcing?

In simple terms, it’s all about finding great property deals and selling them to other investors for a fee. Many property investors lack the time to actively look for deals to grow their portfolios. That’s because, in reality, finding and negotiating deals can be very time-consuming. Hence, investors are happy to pay a deal sourcer a fee for a good bargain. This naturally requires that the investor can still make a healthy profit or monthly income from the property.

And wait until you hear the best part of deal sourcing! The fees you can expect to get from deal sourcing usually range between £2K to £5K per deal. So sourcing one deal a month will be enough to cover a month’s salary from a regular 9-5 job! Or, similar to the rent-to-rent strategy, the income from deal sourcing can then be saved to invest in your own properties.

Things to consider when deal sourcing

A typical property deal includes an offer that you negotiate with a vendor. The seller would have signed either an option or sales agreement with you to sell their property at an agreed price. However, a good deal is more than just a good price. You will also need to present to the buyer with any key due diligence. This can include information such as potential rental income or estimations on refurbishment costs. The investor needs to know that you have done all of your due diligence not only on the property but also on the area.

Be mindful that there are some rules and regulations to prevent buyers from losing money by being sold bad deals. Therefore, you will need indemnity insurance and ideally to have a limited company set up. Finally, you will need to be registered with the Property redress scheme.

Real Estate Investment Trust (REIT)

A REIT or Real Estate Investment Trust is a method of investing in property indirectly without owning a single brick yourself. It’s a common way for investors to invest in property without needing to get involved with any day-to-day requirements such as management or maintenance.

In fact, the way REITs work is closer to stock investing than “traditional” property investing. This is because REITs are property investment companies listed on a stock exchange. They own and manage the properties on behalf of shareholders. Therefore, as an investor, you buy shares in the REIT and if the company goes well, you receive a dividend – a share of the profits. Similar to any other stock, you can also make money if the share price goes up. This allows you to sell for a higher price than you originally bought at. On the other side, you can also lose money by selling when the stock price has dropped.

How to Make Money from Property - Final Thoughts

We have now explored nine different ways to make money from property. As we have learned, not all property strategies require a huge amount of money. This gives an opportunity for anyone interested in diversifying their income through property to get started.

Before you make any decisions about investing in property, make sure you do your research and due diligence. You’ll also want to look at what investment strategy might better suit your goals and circumstances. If you want to earn passive income to become financially free, look into one of the cash flow strategies, such as buy-to-let or serviced accommodation. Or if you don’t have much money, rent-to-rent and deal sourcing can be great ways to start making income with little initial investment.

Although it’s crucial to do proper research before investing, don’t forget that the only way to make money from property is to take action and get started! The number one regret many investors will tell you is that they didn’t start earlier!

Very informative piece, thank you!