Artificial intelligence (AI) is quickly changing the way we interact with the world around us, and budgeting personal finances is no exception. AI-powered budgeting apps can help you track your spending, identify areas where you can save money, and create and stick to a budget more easily than ever before. These apps connect to your accounts, analyse your habits, and offer personalised money-saving tips, from cutting unnecessary expenses to saving for goals.

In this article, we’ll discover five top AI budgeting apps available in the UK, simplifying your choice among the many available options. We’ll also provide additional insights on how they work and how to make the most of them.

Overview: Best AI budgeting apps UK

- Plum: Saves and invests your money for you automatically.

- Emma: Tracks your spending across all of your accounts and provides you with insights into your spending habits.

- Snoop: Finds you better deals on products and services and helps you improve your credit score.

- Chip: Automatically invests your spare change and helps you reach your financial goals faster.

- Moneyhub: Track, budget, and save in one place, with insights into your spending and investments.

How do AI-powered budgeting apps work?

AI-powered budgeting apps use artificial intelligence (AI) to help you manage your money better. They securely connect to your bank accounts and credit cards to understand your spending habits.

These apps can also assist in budgeting by suggesting a budget based on your income and expenses. You can track your spending with the app, and it will alert you if you’re overspending in any category.

Here’s a simple example of how they work:

- Connect your bank accounts and credit cards.

- The app studies your spending habits.

- It suggests a budget based on your income and expenses.

- You track spending with the app.

- Get alerts if you’re overspending in any category.

Benefits of using an AI budgeting app

There are many benefits to using an AI for budgeting your personal finances, including:

- Convenience: AI budgeting apps can automatically track your spending and categorise your expenses, saving you time and effort.

- Accuracy: These apps are highly accurate, so you can be confident that you’re getting a clear picture of your financial situation.

- Personalisation: AI budgeting apps can provide you with personalised recommendations and insights based on your spending habits. This can help you to identify areas where you can save money and create a budget that works for you.

- Automation: They can automate many of the tasks involved in money management, such as creating a budget, saving and investing.

- Motivation: AI budgeting apps can also provide you with feedback and encouragement on your budgeting progress. This can help you to stay motivated and on track with your financial goals.

Overall, AI budgeting apps can be a valuable tool for anyone who wants to save money and improve their financial situation.

Top 5 AI-powered budgeting apps in the UK

If you are looking for an alternative to traditional budgeting, AI-powered budgeting apps can be the right solution for you. We’ve rounded up the top five budgeting apps in the UK to help you track your spending, save money, and reach your financial goals.

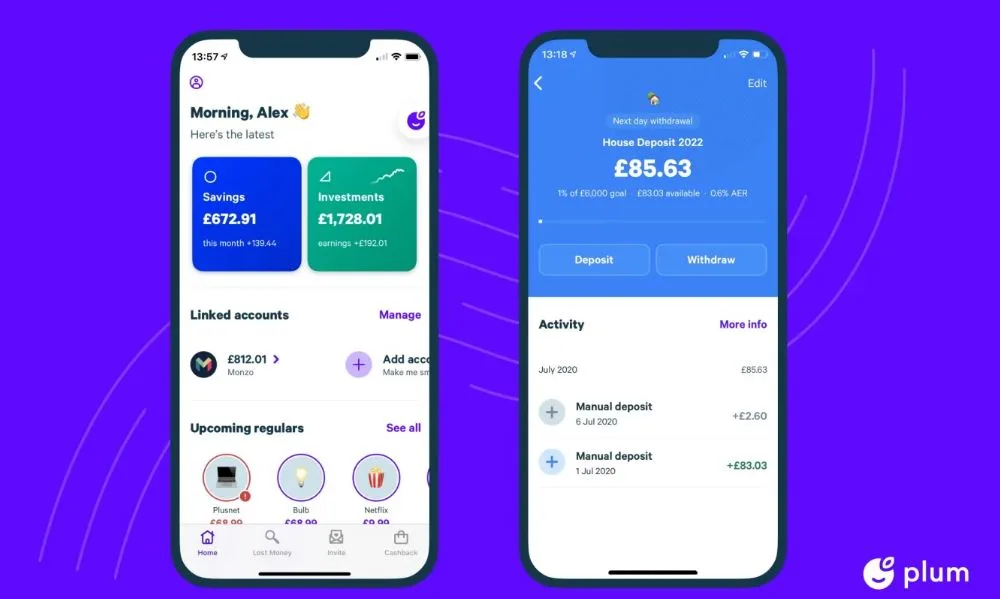

1. Plum

Plum is one of the most popular budgeting apps in the UK that harnesses the power of artificial intelligence. It’s designed to make budgeting easy for everyday users. With Plum, you can keep tabs on your spending, find ways to save, and set up a budget that you can stick to. The app goes beyond budgeting, offering automatic and round-up savings, investment choices, and cashback options. It has earned a Trustpilot rating of 4.2, and more than one million users in the UK.

Plum’s AI features include:

- Automatic spending tracking: Plum automatically tracks users’ spending by connecting to their bank accounts. This saves users time and effort, and it also ensures that their spending data is accurate.

- Spending insights: Plum provides users with insights into their spending habits, such as where they are spending the most money and how their spending has changed over time. This information can help users to identify areas where they can save money.

- Budgeting tools: Plum helps users to create and stick to a budget. It provides users with a variety of budgeting tools, such as the ability to set spending limits and create savings goals.

Plum: Pros & Cons

Pros:

- Comprehensive features: Plum offers a wide range of features, including automatic spending tracking, spending insights, budgeting tools, automatic savings, investment options, ISAs and cashback.

- Easy to use: Plum is a very easy-to-use app. It has a clean and user-friendly interface, and it is easy to navigate.

- Cashback offer: As a new user, you can get £5 free cashback if you have at least £100 in your Plum account for 90 days (Ts&Cs apply).

- Free trial: All the paid plans have a 1-month free trial so you can test them before committing.

Cons:

- Free version limitations: Best savings rates and features are reserved for paid-for versions only. However, the paid versions are more affordable than some of the other apps covered in this article.

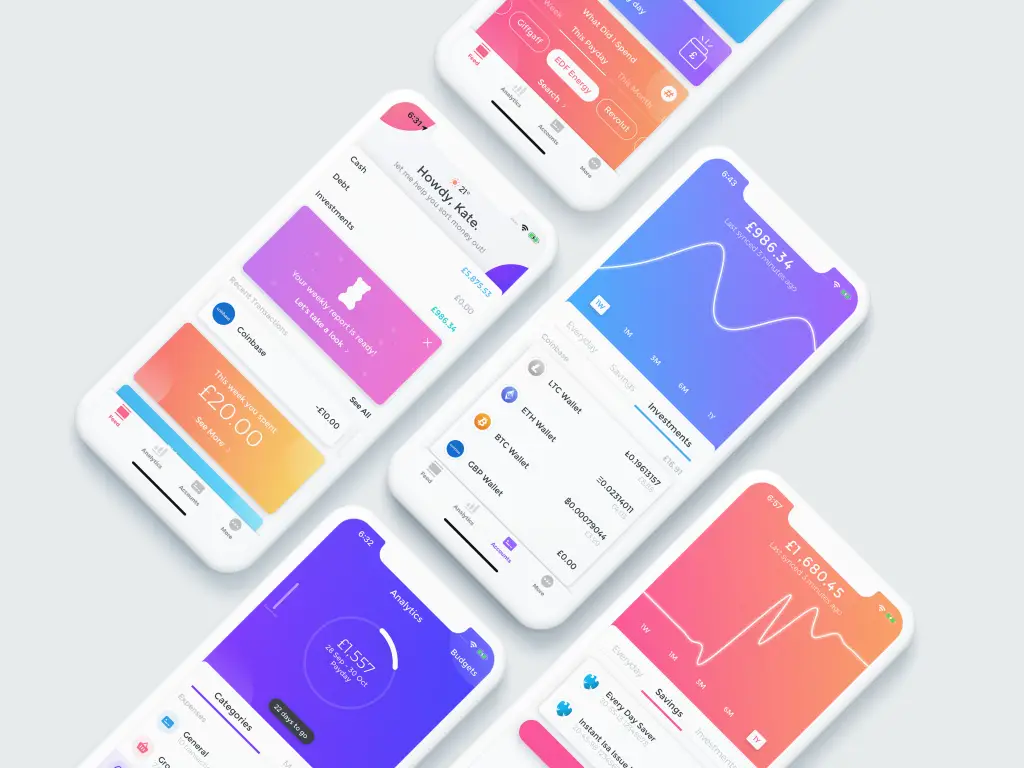

2. Emma

Emma is a budgeting app that uses AI to help users track their spending, identify areas where they can save money, and create and stick to a budget. The app also offers a number of other features, such as subscription tracking, bill reminders, and personalised financial insights. With a Trustpilot rating of 4.1, Emma is trusted by 1.3 million customers in the UK.

Emma’s AI features include:

- Automatic spending tracking: Emma automatically tracks users’ spending by connecting to their bank accounts. This saves users time and effort, and it also ensures that their spending data is accurate.

- Spending insights: The app provides users with insights into their spending habits, such as where they are spending the most money and how their spending has changed over time. This information can help users to identify areas where they can save money.

- Budgeting tools: Emma helps users to create and stick to a budget. It provides users with a variety of budgeting tools, such as the ability to set spending limits and create savings goals.

Other features:

- Subscription tracking: Emma tracks users’ subscriptions and helps them to identify and cancel unused subscriptions.

- Bill reminders: It reminds users of upcoming bills and due dates. This can help users to avoid late payments and fees.

- Personalised financial insights: Emma provides users with personalised financial insights, such as their spending trends, net worth, and credit score. This information can help users to make informed financial decisions.

Emma: Pros & Cons

Pros:

- Comprehensive features: Emma comes with a variety of features, such as automatic spending tracking, spending insights, budgeting tools, subscription tracking, bill reminders, investing and personalised financial insights.

- Easy to use: The app has a clean and user-friendly interface, and it is easy to navigate.

- Affordable: Emma offers a free plan with a number of features, as well as a paid plan with additional features.

Cons:

- Lack of tracking: No week-by-week or month-by-month comparison feature, which makes it harder to track changes in spending habits.

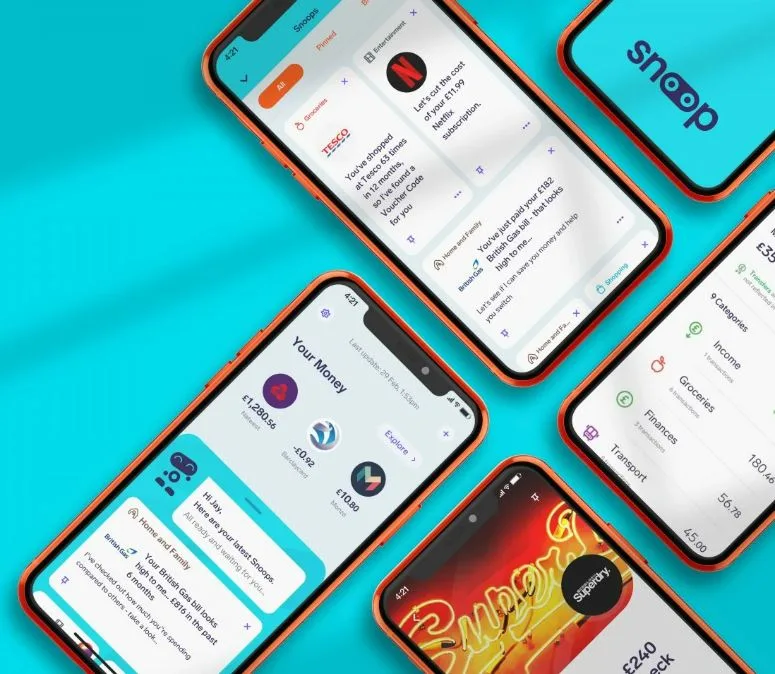

3. Snoop

Snoop is an AI-powered app specialising in budgeting and money management. With around 1.2 million users and a Trustpilot score of 3.4, it’s one of the most popular budgeting apps in the UK. The app uses AI to help users track their spending, save money, and find better deals on products and services. Snoop also offers a number of other features, such as bill reminders and credit score monitoring.

Snoop’s AI features include:

- Automatic spending tracking: Snoop automatically tracks users’ spending by connecting to their bank accounts and credit cards. This saves users time and effort, and it also ensures that their spending data is accurate.

- Spending insights: The app provides users with insights into their spending habits, such as where they are spending the most money and how their spending has changed over time. This information can help users to identify areas where they can save money.

- Budgeting tools: Snoop helps users to create and stick to a budget. It provides users with a variety of budgeting tools, such as the ability to set spending limits and create savings goals.

Other features:

- Bill reminders: Snoop reminds users of upcoming bills and due dates. This can help users to avoid late payments and fees.

- Credit score monitoring: The app also monitors users’ credit scores and provides them with alerts if their credit score changes. This can help users to stay on top of their credit health.

- Exclusive discounts: Cut your bills by comparing different insurances, mortgages and more.

Snoop: Pros & Cons

Pros

- Comprehensive features: Snoop offers a wide range of money management features, including automatic spending tracking, spending insights, budgeting tools, deals and discounts, bill reminders, and credit score monitoring.

- Affordable: Snoop provides both free and paid plans, with the paid plan being cheaper than those of competing apps.

Cons

- Lack of saving and investing options: Snoop is specifically focused on budgeting so it doesn’t offer interest, investments or banking products like some other competitor apps.

4. Chip

Chip is a popular AI-powered budgeting and investment app in the UK. It uses AI to help users track their spending, save money, and invest for the future. Chip also offers a number of other features, such as automatic savings, investment funds, and access to exclusive discounts. 3.4 Trustpilot, around 500,000 + registered users.

Chip’s AI features include:

- Automatic spending tracking: Chip automatically tracks users’ spending by connecting to their bank accounts. This saves users time and effort, and it also ensures that their spending data is accurate.

- Spending insights: Chip provides users with insights into their spending habits, such as where they are spending the most money and how their spending has changed over time. This information can help users to identify areas where they can save money.

- Investment recommendations: The app analyses users’ spending habits and bank balances and estimates how much they can afford to save or invest. They then offer the opportunity to invest in highly respectable funds worldwide. This makes it easy for users to get started with investing, even if they have no prior experience.

Other features:

- Automatic savings: Chip automatically saves money for users on a regular basis. This can help users to save money without even thinking about it.

- Investment funds: Chip offers a Stocks and Shares ISA and a variety of investment funds to users, including index funds, exchange-traded funds (ETFs), and actively managed funds.

Chip: Pros & Cons

Pros:

- Comprehensive features: Chip offers a lot of helpful features like automatic spending tracking, spending insights, investment recommendations, automatic savings, investment funds, and access to exclusive discounts.

- Interest rates: It tends to pay competitive interest rates on the Instant Access account.

- Affordable: Chip provides a free plan with various features, and they also offer a paid plan with extra functionalities. Notably, their paid plan is among the most budget-friendly options available in the budgeting app market.

Cons:

- Usage limitations: While Chip is easy to set up, it has some limitations. For example, deposits take days to appear in your account and you can’t connect all banks to the app.

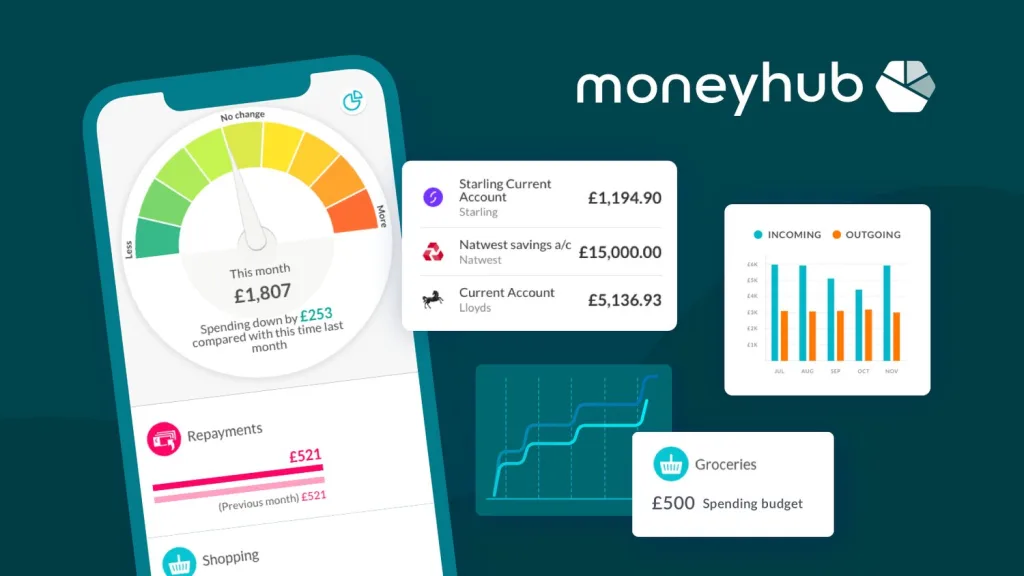

5. Moneyhub

Moneyhub is a UK-based financial management app that has a Trustpilot rating of 3.5. Moneyhub offers a smart AI feature that helps users get a complete view of their finances, track their spending, identify savings opportunities, and budget more effectively.

Moneyhub’s AI features include:

- Proactive Assistant: The Proactive Assistant analyses your spending data and identifies potential problems, such as upcoming bills that you may not have enough money to pay or overdraft charges. It can also suggest ways to save money, such as by switching energy providers or cancelling unused subscriptions.

- Spending analysis: Moneyhub provides you with insights into your spending habits, such as where you are spending the most money and how your spending has changed over time. This information can help you to identify areas where you can save money.

- Budgeting tools: The app uses AI to help you create and stick to a budget. It can automatically categorise your spending and set spending limits for each category. You can also receive alerts when you are approaching your spending limits.

Other features:

- Bill reminders: You can set up reminders for upcoming bills and due dates. This can help users to avoid late payments and fees.

- Account aggregation: Moneyhub allows you to connect all of your financial accounts to the app in one place. This includes bank accounts, credit cards, savings accounts, mortgages, pensions, and investments. Once you have connected your accounts, Moneyhub will automatically update your account balances and transactions so that you have a complete view of your finances at all times.

Moneyhub: Pros & Cons

Pros

- Complete view of your finances: Moneyhub connects all your financial accounts, so you can see all your money and track your spending and budget.

- Desktop version: In addition to the app, Moneyhub also has a full desktop version.

- Budget-friendly: Moneyhub’s subscription fee is cheaper than a number of rival budgeting apps.

Cons

- No savings or investment options: While Moneyhub can connect all your external savings and investment accounts and alert you to potential savings opportunities, it doesn’t directly provide in-app savings or investment accounts.

How to make the most of AI budgeting apps

- Choose an AI-powered budgeting app: There are many AI budgeting apps available in the UK, such as Plum, Emma, Snoop, Chip, and Moneyhub. Each app offers different features, so it is important to choose one that fits your needs. Consider what features are important to you, such as spending tracking, budgeting tools, or investment options. You can also read reviews of different apps to get feedback from other users. Once you have chosen a few apps that you are interested in, try them out to see which one you like best.

- Set clear financial goals: Clearly define your financial objectives. Whether you aim to reduce spending, increase savings, or invest for the future, having specific goals will help the AI app create a tailored budgeting plan.

- Track your spending: Let the AI do the heavy lifting by tracking your spending automatically. Most AI budgeting apps connect to your bank accounts, credit cards and even loans to provide real-time updates on where your money is going.

- Automate savings and investments: Take advantage of AI’s ability to automate your savings and investments. Set up recurring transfers to your savings or investment accounts. This “pay yourself first” approach ensures you prioritise saving before spending.

- Leverage insights: Dive into the insights generated by the AI app. Understand your spending habits, identify areas where you can cut back, and make informed financial decisions. AI can provide valuable recommendations based on your financial history.

- Prioritise security: Ensure the AI budgeting app you choose is registered and regulated by the Financial Conduct Authority (FCA). Keep your login credentials secure and regularly update your passwords for added protection.

By following these six tips, you can make the most of AI-driven personal budgeting and work towards achieving your financial goals with confidence.

Conclusion

In today’s tech-driven world, managing your finances has never been easier, thanks to the emergence of AI-powered budgeting apps. We’ve introduced you to the top five options available in the UK – Plum, Emma, Snoop, Chip, and Moneyhub. These apps offer a range of features to help you keep a close eye on your spending, make informed financial decisions, and ultimately achieve your money goals.

The key is to explore these apps, try a couple out, and see which one aligns best with your unique financial needs. So, give one of these apps a whirl and get your finances in order.

This post may contain affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you, supporting our content creation.