Whether you wanted to save for a first home, holiday or early retirement, setting a savings goal can help you reach your target faster.

HSBC & YouGov research shows younger adults are leading the way when it comes to saving for the future. However, they’re also the most likely to raid their nest eggs because of over-spending. So how can you set a savings goal you can actually hit? Read on to learn more about setting successful savings goals!

Sponsored content: We are working with HSBC to give you tips on why and how to set savings goals. All figures, unless otherwise stated, are from YouGov Plc for HSBC.

Why is setting savings goals important?

Setting financial goals is important for various reasons, yet only 36% of people in Britain have set a savings target.

Specific goals don’t only help you to begin saving money but also help you to stay motivated in the process. When you are simply leaving money in your current account, it can be easy to spend some of the money you had earmarked for savings. But when you have a savings goal you are working towards, you are more likely to keep yourself focused and accountable.

Defining your goal will also allow you to create a realistic plan to reach it. For example, if your long-term goal is to gain financial freedom and retire early at 45, it’s unlikely that cash savings alone will take you there. Hence, you will need to create a plan to make your money work harder for you through investing.

Saving vs Investing

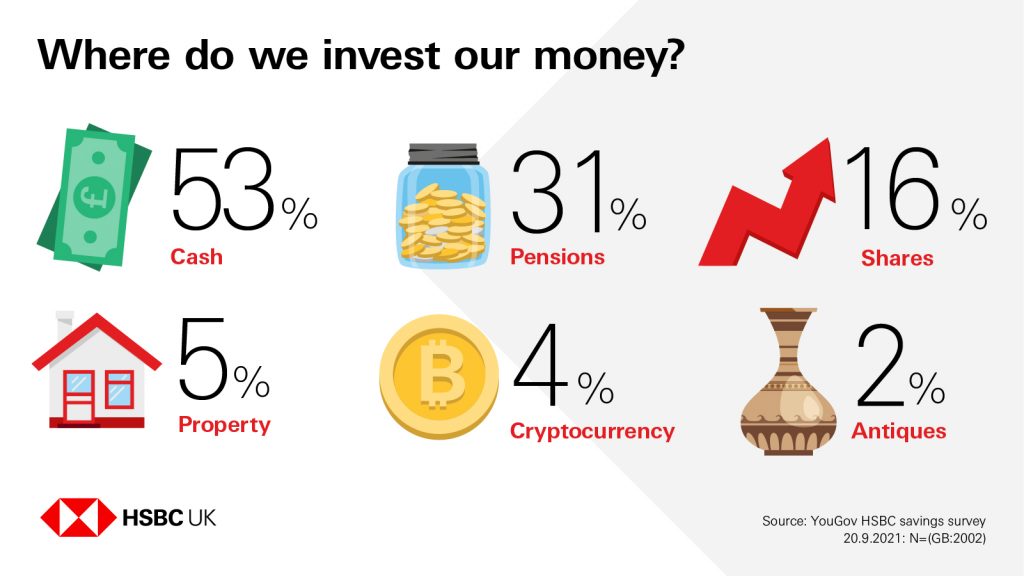

Research on behalf of HSBC reveals that cash savings are by far the most popular way to plan for the future with more than half using that as a way to put money aside. However, as the above example shows, cash savings are not always the best way to reach your financial goals. So when should I look to save or invest my money?

Saving accounts are often a good way to save money short to medium-term (less than 5 years). This is because if you invest for under 5 years, your investment may not have enough time to make up any fall in value.

However, with soaring inflation rates, cash savings accounts are generally not the best places to put your money long-term. The interest is typically lower than inflation, meaning your buying power is reduced. Essentially, inflation will start eating your savings. Therefore, the money you’re not going to need for a few years could earn you a greater return when invested.

Tips to set your savings goals

We now understand why setting savings goals is important – but how do I start setting them?

Here are a couple of useful tips to get started:

- Decide what your priorities are and write them down. Why do you want to save a certain amount? Try to find something that excites and motivates you.

- Categorise your ambitions and targets into short, mid and long-term goals.

- Apply a SMART goal-setting strategy. In other words, make sure your targets are Specific, Measurable, Achievable, Realistic and Timely.

Examples of SMART savings goals

- You want to buy your first property: To save £40,000 for a house deposit within the next five years (long-term). This equals saving £8,000 a year (mid-term) and £667 a month (short-term).

- You’ve just found out you/your partner is pregnant and want to financially prepare for the baby: To save £7,000 in the next 8 months to prepare for the drop in income when me/my partner is on maternity leave. This means saving £875 a month.

- You want to invest in a luxury item with the hope of owning a classic designer item that retains its value long-term: To save £3,360 to purchase a Chanel mini flap bag (price at the time of writing) in one year. This equals saving £280 a month.

- You want to pay off credit card debt: To save £1000 in the next 6 months to pay off all your remaining credit card debt. This means saving £167 a month.

How to stick to your savings goals

- Create a realistic budget: Understand your incomings and outgoings and work around them to address your goals. Then, create a realistic budget you can stick to. Don’t forget to account for an emergency fund either. Accordingly to HSBC research, unexpected life events are the main hurdle to not reaching your financial goals.

- Automate your goals: Have any money allocated to your savings goals automatically transferred into a separate account, such as a savings or investment account.

- Monitor your progress: Staying on top of your progress helps you to ensure you are hitting your savings benchmarks. If you don’t manage to hit a certain benchmark, take some time to re-evaluate what to do differently moving forward.

- Don’t forget to enjoy your life: Saving for specific goals often require some sacrifices when it comes to spending. However, this doesn’t mean you should stop all recreational spending! For example, rewarding yourself for hitting certain benchmarks can give you more motivation to continue your saving journey and reach your final goals.

This was really helpful! I feel like I have saving somewhat under control but I could definitely start setting actual goals! Thanks for the post 🙂

Thanks, I’m glad you found the post helpful! Hopefully it gave you some inspiration to set your savings goals 🙂

Saving is so important. It’s about valuing the comfortable more than the uncomfortable.

Agreed – although working towards your savings goals can feel uncomfortable at times, the long-term comfort of hitting your goals makes it all worthwhile 🙂

Great tips. This is definitely something I need to work towards!

Thanks, hope this gave you some inspiration to set your own savings goals!

One of my goals this year was to get better with my finances. This was super helpful on giving me actionable steps!

Great post! It’s so important to remember that saving doesn’t mean depriving yourself of all things you enjoy. It just means being responsible with your money and putting some of it away!

You give all great tips for us to reach our financial goals. Thank you for making it simple.

A very informative post and clearly written. Thank you

I need to do this more

This post couldn’t come at a better time. My partner and I are trying to save, but are struggling.

This article motivated me to star planning better my savings, thank you for this great post!

Setting financial goals is so important and it’s really important to start setting those goals when you’re young. I recently retired myself and well….let’s just say I didn’t follow anyones advice (Shane on me) and although I have a decent amount in my savings it’s not as much as I would have liked – especially since I can’t get Social Security for another 5 years.

This is important because it allows people to track their progress and ensure that they are on track to reach their financial goals. Additionally, setting savings goals can help motivate people to save more money.

I’m sure I’ll be a savy saver in no time 🙂

The way things are going these days trying to save can be challenging! These tips will surely come in handy. Thanks for sharing!

Great post! I love how detailed it is and it really gives people the information they need. I’m really going to focus on setting some saving goals. Thanks for this really helpful post!

Saving is something that I found really difficult at first but I changed the mode to something beneficial and started learning about investments and now I love doing it.

Amazing article

So hard to find any investment that can keep up with inflation these days!

Yes! start on a realistic plan, then slowly increase everything up including the savings amount so the change wont be that drastic making it easier to do.

love these tips! thanks for sharing

These are some great tips. It’s so hard to save money when we live paycheck to paycheck. But slowly but surely I am making it happen. You’re right some of the problem is over spending.

Great article on how to set savings goals! I appreciate the step-by-step approach and the emphasis on setting specific, measurable, and achievable goals. The tips on creating a budget and understanding your cash flow, in addition to the importance of tracking your progress and reassessing your goals regularly are also very valuable. It’s important to have a plan and a clear idea of what you are saving for, in order to stay motivated and on track.

I also liked the emphasis on creating an emergency fund and the importance of having a safety net for unexpected expenses, which is crucial in being able to achieve your savings goals. The advice on how to automate savings and the power of compound interest are also very valuable.

Overall, this is a valuable resource for anyone looking to set and reach savings goals. The article provides valuable information, expert insights, and clear explanations, that can help you understand how to set realistic and achievable savings goals and stay on track to reach them.