Do you ever feel like your finances could be better organised? You’re not alone. Many people struggle to keep track of their spending, savings, and investments. But what if there was an app that could help you with all of that?

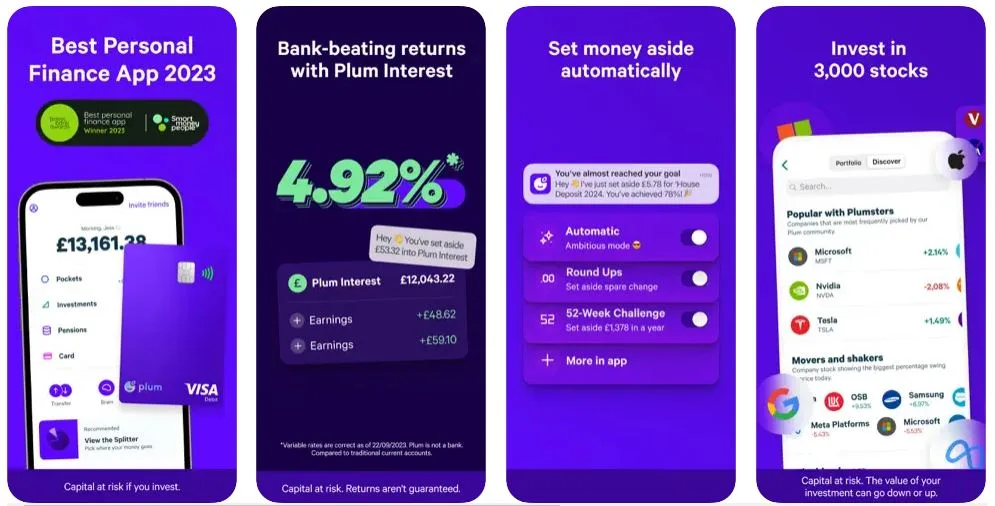

That’s where Plum comes in. Plum is a financial management app that can help you save money, invest, and manage your finances more effectively. It’s a one-stop shop for all things money, and it’s incredibly easy to use.

In this Plum app review, we’ll take a closer look at Plum, how it works, and whether or not it’s worth using. We’ll also cover the pros and cons of the app, as well as some tips for getting the most out of it.

What is Plum and how does it work?

Plum is a smart money management app that enables you to save, invest and budget. It has over 1.8 million registered users in the UK and EU. Plum uses open banking technology to connect to your bank accounts and credit cards, so you can see all of your finances in one place. Plum also uses AI to analyse your spending habits and tailor auto-deposits, which can help you save money.

Plum’s key features include:

- Account linking: Plum can link to your bank accounts and credit cards, so you can see all of your finances in one place. This can help you get a better understanding of your spending habits and identify areas where you can save money.

- Budgeting: Plum helps you track your spending and create a budget. It will track your spending and notify you when you are approaching your limits.

- Saving: Plum can automatically set money aside for you, based on your budget and goals. You can set up different types of auto-deposit rules, such as round-ups, paydays, and Rainy Days. Plum will automatically deposit money from your linked bank accounts into your Plum savings pockets.

- Investing: Plum offers an investing platform where you can invest in stocks and funds. You can choose to invest manually or set up automatic investments. The app also offers a variety of investment funds that are tailored to different risk tolerances and investment goals. Capital at risk if you invest.

Plum App: Pros & Cons

Pros:

- Easy to use and navigate

- Wide range of features, including account linking, budgeting, saving and investing

- Competitive fees

- ISAs and free savings accounts available

- AI-driven budgeting and spending analysis

- Good selection of stocks and funds

- Positive customer reviews (one of the best-rated money management apps in the UK)

- 1-month free trial on paid plans

- Free cashback offer (£5 free cashback if you have at least £100 in your Plum account for 90 days, Ts&Cs apply)

Cons:

- Tiered fee levels: To access all of Plum’s investment options and best savings rates, you may need to subscribe to higher-tier plans, which come with additional fees.

- Lack of educational resources: Plum doesn’t provide extensive educational resources for users looking to learn more about investing.

- Not ideal for short-term traders: Plum is better suited for long-term saving and investing rather than short-term trading.

Who is the Plum app good for?

Plum is a good option for people who are looking for a comprehensive money management app that allows them to keep all finances in one place.

It is especially well-suited for people who want to automate their finances from budgeting and saving to investing. While it does not provide personalised financial advice, it can be a great tool for beginner investors and savers, or for those who want to save and invest their money more wisely.

In contrast, if you are already super comfortable managing your money on your own, you may not need the features that the Plum app offers.

Plum's main features

Plum offers a variety of useful features to manage your finances. Here is a more detailed look at some of Plum’s key features:

Account linking

Plum’s account linking feature allows you to connect your bank accounts and credit cards in one place. This gives you a complete overview of your finances, making it easier to track your spending and savings. When you get a complete overview of your finances, including your income, expenses, and savings, it is easier to make informed financial decisions and set financial goals.

Budgeting

Plum uses AI to help you create a budget, track your spending, and get insights into your spending habits. For example, Plum can use AI to:

- Analyse your spending habits and identify areas where you can cut back.

- Help you create a budget that is tailored to your individual needs and financial goals.

- Automatically track your spending and compare it to your budget.

Plum’s AI-powered budgeting features can help you save money, reach your financial goals, and make better financial decisions.

Saving

Plum’s savings pockets (provided by Investec Bank Plc.) are a flexible way to save money for different goals. You can create multiple savings pockets and set different goals for each one, such as saving for a holiday, house deposit or retirement. Plum can also help you automate your savings with a variety of auto-deposit rules, such as:

- Round-ups: Plum will round up your debit card transactions to the nearest pound and deposit the difference in your Plum savings pocket.

- Pay Days: Plum will automatically set aside a certain amount of money from your paycheck each time you get paid.

- Rainy Days: Plum will automatically deposit money whenever it rains in your chosen location.

- Naughty Rule: Plum will automatically set aside money whenever you shop at your chosen “naughty” retailers.

- 1p challenge: Plum will automatically deposit money for each day of the challenge, starting with 1p and increasing in 1p increments for 365 days.

- Automatic: Plum’s algorithm will analyse your income and expenditure to work out what you can set aside without leaving yourself short.

Investing

Plum’s investing features allow you to invest in stocks and funds, and automate your investments with repeat buy orders and price alerts. This means you can invest consistently and make informed investment decisions, which can help you grow your money over time – even if you don’t have a lot of money to invest upfront or the time to actively manage your investments.

Plum offers the following types of investment accounts:

- General Investment Account (GIA): A GIA is a standard investment account that is not tax-advantaged. This means that you may have to pay capital gains tax on any profits you make from your investments.

- Stocks and Shares ISA (S&S ISA): A S&S ISA is a tax-efficient investment account that allows you to invest up to £20,000 per year without paying capital gains tax on your profits. This means that you can keep any profit you make from your investments.

- Self-Invested Personal Pension (SIPP): A SIPP is a pension account that allows you to invest in a variety of funds. SIPPs can be a good way to save for retirement and to benefit from tax breaks.

Plum's other features

While the above key features are the most common and useful for the majority of Plum users, the app also has some additional and less-know features. These include:

- Plum Card: The Plum Card is a debit card that is linked to your Plum account. Pre-loading your card with a set amount of money can help you resist impulse purchases, track your spending, and gain a better understanding of your financial habits. Plum won’t charge you for using your card abroad. You’ll just be charged Visa’s daily exchange rate.

- Notifications: Plum can send you notifications about your spending, savings, and investments. This can help you stay on track with your financial goals.

Pricing

Plum has four different plans: Basic, Pro, Ultra, and Premium. The Basic plan is free and includes access to some of Plum’s core features, such as account linking, budgeting, and automatic savings deposits. The Pro, Ultra, and Premium plans offer additional features, such as more savings options, investing, and a debit card.

Here is a breakdown of the different plans:

| Plan | Price | Features |

|---|---|---|

| Basic | Free | Earn 4.97%* AER interest, use account linking, budgeting, automatic deposits and a choice of over 1,200 company stocks |

| Pro | £2.99/month | All Basic features, a better rate of interest (4.97%* AER), plus Rainy Days Rule, 52-week Challenge, up to 15 savings pockets, occasional cashback offers, 13 investment funds |

| Ultra | £4.99/month | All Pro features, plus Naughty Rule, 1p challenge, Money Maximiser, Plum debit card |

| Premium | £9.99/month | All Ultra features, Plum’s best rate of interest (5.12%* AER) plus up to 3,000 stocks, price alerts and recurring buy orders |

Easy access interest pockets are provided by Investec Bank Plc. *Rates correct as of 3rd April 2024.

Capital at risk if you invest.

Which plan is right for me?

The best plan for you will depend on your individual needs and budget. If you are new to Plum and are just getting started, I recommend starting with the Basic plan. This will give you access to the core features of the app and allow you to test it out before you commit to a paid plan.

If you are looking for more features, such as Rainy Days, 52-week Challenge, and investing, then you may want to upgrade to the Pro or Ultra plan. The Premium plan is the best option for people who want access to all of Plum’s features, including the highest interest rates.

Plum app reviews: What do customers say?

Plum has a rating of 4.2 out of 5 stars on Trustpilot, with over 5,000 reviews. In addition to this, the app has a rating of 4.4 with over 51,000 ratings on the Apple App Store, and 4.6 rating with 31,400 reviews on the Google Play Store. With this in mind, it is fair to say that customers generally love Plum!

Customers generally praise the app for its ease of use and comprehensive features. However, there are also some negative Plum app reviews, with some users complaining about the app’s customer support and fees. These review scores are just a general indicator of how customers perceive the Plum app.

Plum app: FAQ

Is Plum safe and trustworthy?

Yes, Plum is a safe and trustworthy money management app. It is regulated by the Financial Conduct Authority (FCA) in the UK interest pockets and investments are covered by the Financial Services Compensation Scheme (FSCS). This means that customers’ money is protected up to £85,000 per person, per platform, in the event that Plum goes bankrupt.

Plum also uses a variety of security measures to protect its users’ data, including:

- 256-bit TLS encryption

- Face and fingerprint recognition

- Regular security audits

Overall, Plum is a safe and trustworthy app. While no financial app is completely risk-free, Plum takes steps to protect its users’ money and data.

Can Plum make you money?

Yes, Plum can help you make money in a few ways. It can automatically save money for you based on your spending habits and savings goals, and it can also help you invest your money. If your investments go up in value, you can sell them for a profit. The app also provides competitive interest rates for your savings.

However, it is important to note that there is no guarantee that you will make money by using Plum. But if you are disciplined and consistent with your saving and investing, Plum can help you reach your financial goals over time.

How easy is it to withdraw money from Plum?

Is Plum good for savings?

Is Plum good for beginners?

Is Plum only for the UK?

No, Plum is not only for the UK. It is currently available in the following European countries:

- UK

- Ireland

- France

- Spain

- Portugal

- Italy

- Netherlands

- Belgium

- Greece

- Cyprus

To use Plum, you must have a bank account and be tax-registered in one of the countries listed above. However, note that the financial products offered in each market will vary.

Plum is still expanding into new markets, so it is possible that it will become available in more countries in the future.

Does Plum charge a fee?

Plum charges a monthly fee for its Pro, Ultra and Premium accounts, as well as additional fees for investments. The Basic account is free, but it has limited features.

The Pro account costs £2.99 per month and includes higher interest rates on savings pockets and access to premium investment features. The Ultra account costs £4.99 per month and includes all of the features of the Pro account, plus access to a Plum Card. Finally, Premium customers pay £9.99 per month and get extra stock options (3,000 rather than 1,200), and can also set up price alerts for stock movements, and use recurring buy orders to help automate the investing strategy they set.

If you choose to invest in funds with Plum, you will need to pay a minimum of £2.99 for the Pro account to access the function. In addition to this, investments incur a product provider fee of 0.45%, plus a 0.06%–1.06% fund management fee (depending on the funds you select).

There are no other hidden fees associated with Plum.

Whether or not Plum is worth the fee depends on your individual needs and financial goals. If you are looking for a convenient and easy-to-use way to save money, invest, and manage your finances, then Plum may be a good option for you. However, if you are on a tight budget, you may want to consider a free alternative.

Plum app review: Is it worth it?

If you are looking for an easy way to handle different aspects of your finances through a single platform, then Plum can be a great option for you. While it might not have the highest interest rates or the lowest investment fees in the market, it offers a convenient one-stop shop for managing your finances. With Plum, there’s no need to juggle multiple accounts separately, be it your checking account, savings account, or investment portfolio.

I would especially recommend Plum for those who are just starting their financial journey because it can help you automate budgeting, saving and even investing. Personally, I’m a big fan of automating finances as it allows a simple but effective way to manage money without having to think about it too much.

Plum app tips: How to make the most of it

To wrap up this Plum app review, here are my additional tips to make the most of the app:

- Start with the free Basic plan. This will give you access to the essential features of Plum, so you can try it out before you commit to a paid plan.

- If you’re considering a paid plan, review the features most valuable to you and choose a plan accordingly. All paid plans offer a 1-month free trial, so you can test them out before committing.

- Take advantage of the AI-driven budgeting and spending analysis tools. These tools can help you to identify areas where you can cut back on spending and set realistic savings goals.

- Do your own research before making any investment decisions. Plum does not provide personalised financial advice, so it is important to understand the risks and rewards before you start investing. Remember that the value of your investments can go down as well as up.

- Take advantage of the £5 free cashback. As a new user, you can get a £5 free cashback if you have at least £100 in your Plum account for 90 days (Ts&Cs apply).

This post may contain affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you, supporting our content creation.