The top 1% of earners in the UK are a topic of much speculation. Some people believe that they make an exorbitant amount of money, while others believe that they are simply rewarded for their hard work and talent. But how much money do you really need to earn to be among the top 1%? And how do you get to be among the top of UK earners?

In this article, we’ll take a look at the latest data to see how much the UK’s top 1% earn. Read on to learn more about the top earners and how to join their ranks.

What does it mean to be in the top 1% of UK earners?

If you are in the top 1% of the UK’s earners, you belong to a group of around 320,000 people that:

- Earns 13% of all taxable income in the UK

- Pays 29% of all income tax in the UK

- Earns an average of £15,250 per month

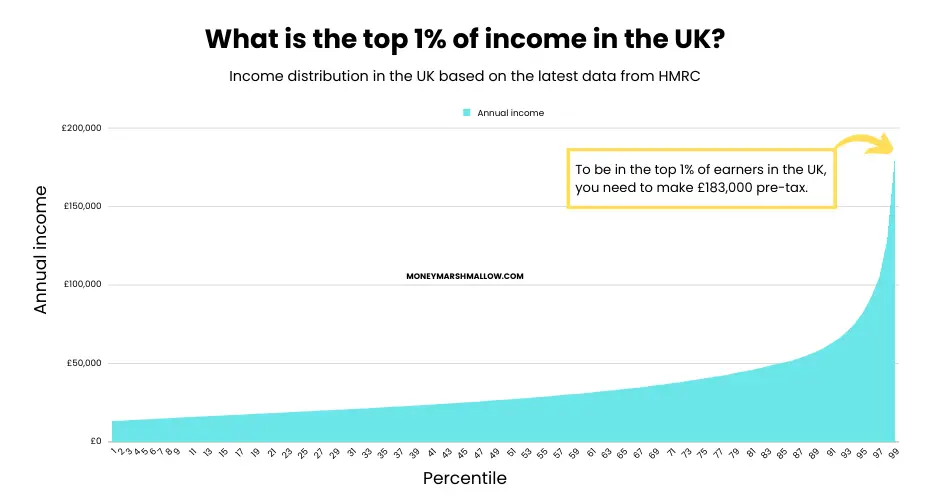

How much do the top 1% earners make in the UK?

According to the latest government data from HMRC, the top 1% of earners in the UK make an annual pre-tax income of £183,000. This is over five times the average UK income of £35,464.

To put this into perspective, the top 1% of earners in the UK make over £15,000 per month and £3,500 per week.

How much is the top 1% income after tax?

The top 1% of highest income earners in the UK pay a significant amount of tax, but they still take home a large amount of money after tax.

On a pre-tax salary of £183,000, the top 1% of earners in the UK will pay £67,310 in income tax and £9,665 in National Insurance. This leaves them with a take-home pay of £106,025 per year.

However, according to the Institute of Fiscal Studies (IFS), business and dividend income account for over a quarter of the total income of the top 1% earners. These types of income have lower taxes, which therefore benefits a large share of the top 1%.

Therefore, the actual after-tax income of the top 1% of earners will vary depending on how much of their income comes from different sources. However, most high earners are likely to have a take-home pay of well over £106,025 per year.

To put this into perspective, the median annual income in the UK is £35,464, according to the Office for National Statistics (ONS). So if you are earning £183,000 a year, your tax and national insurance bill will be more than twice the gross average salary in the UK! However, you will still be taking home nearly 4.5 times the median income after tax.

This is just a general overview of the tax situation for high earners in the UK. Many complex factors can affect an individual’s tax liability, such as pension contributions, benefits and other allowances and reliefs.

How much do you have to make after tax to be in the top 1%?

According to the most recent HMRC data, the top 1% of post-tax earners in the UK earn more than £121,000 after tax. This means that to be in the top 1% of post-tax earners, you need to earn more than £121,000 after tax, not just pre-tax.

The reason why you need to earn more than £121,000 after tax to be in the top 1% of post-tax earners is because the top 1% of earners often have multiple sources of income, such as a salary, dividends and capital gains. For example, dividends are taxed at a lower rate than standard income, so those who earn a chunk of their income from dividends will pay less tax than someone earning their whole income as a salary.

For example, if you earn £183,000 pre-tax, but a chunk of it is in dividends, you may pay less tax than someone earning their whole £183,000 as a salary. As a result, you may not be in the top 1% of post-tax earners, even though you are in the top 1% of pre-tax earners.

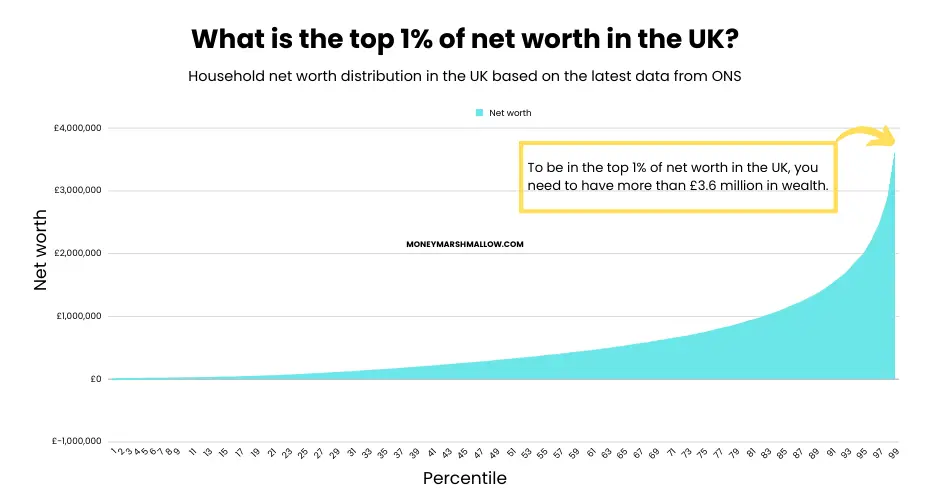

How much is a top 1% net worth in the UK?

According to the latest figures from the Office for National Statistics, households need to have a net worth of at least £3.6 million to be in the top 1%.

Earning a top 1% income doesn’t guarantee that you’ll be one of the wealthiest people in the UK. To build wealth, you need to save, invest, and make your money work for you. Even if you earn a lot of money, you won’t become wealthy if you spend it all.

The median household net wealth in the UK is £302,500. The richest 1% of Britons are estimated to hold more wealth than 70% of Britons. This means that to be in the top 1% of wealthiest people in the UK, you need to have a net worth of much more than £302,500.

It’s possible to reach a net worth of over £3.6 million without ever being a top 1% earner. For example, if you invest £50,000 per year at an 8% annual return, you’ll have a net worth of over £3.8 million in just 25 years if you reinvest your returns. While this requires a high income, it’s achievable if you’re consistent with your investments over the long term. Property investing and starting a successful business can also be great ways to build wealth as both can appreciate while generating income.

Who are the 1% top earners in the UK?

UK’s top 1% of earners earn at least £183,000 per year before tax. According to the IFS, these top 1% of income taxpayers are disproportionately male, middle-aged and London-based. This is likely not a surprise to most.

Here are some additional insights about the 1% earners from the IFS:

- Only 17% of the top 1% are women, meaning men are more than four times as likely as women to be among those with very high incomes. (However, more than 17% of women live in a high-income household because they live with a high earner).

- People with the highest incomes are also more likely to live in London and the South East. These areas account for three-fifths of the top 1%.

- More than a third of people in the top 1% are in their late 40s or early 50s, which is more than double the expected number of people in that age group.

How do the UK's top 1% income earners make their money?

Once you know how much the top 1% earn in the UK, you’re probably wondering what jobs the UK’s highest earners do to earn all that money.

Based on IFS data, employment income is the biggest single source of income for the top 1%. However, it’s important to note that on average, 40% of the 1% earners’ income actually comes from other sources than employment. These can include income from dividends, self-employment, or other businesses.

Many of the UK’s top 1% of earners do not have a high salary of £180,300. Instead, a good portion of their income is made up of partnership and dividend income. These are taxed at lower rates than salaries, and so their net income (their take-home) is higher.

The IFS figures show that business owners are an important part of the top 1% in the UK. Adding up the people in the top 1% whose main source of income is partnership income (14%), dividend income (11%), or self-employment income (4%), we see that almost one in three of the top 1% are business owners, even though they account for only one-in-five of the workforce overall.

What jobs do the top 1% earners do?

- Financial services professionals (e.g., investment bankers, hedge fund managers, private equity investors)

- Lawyers

- Private sector (specialist) doctors and dentists

- Consultants

- Engineers

- IT professionals

- Senior executives in any industry

It is important to note that salaries can vary widely within each of these professions, depending on factors such as experience, skills, and location. For example, a software engineer working in a small startup will likely earn less than a software engineer working at a big tech company.

Conclusion: What is the top 1% of income in the UK

The most recent HMRC data concludes that the top 1% of earners in the UK are earning £183,000 a year pre-tax income. This translates into £15,250 per month or £3,812 per week.

This also means that the top 1% makes over five times the average income of £35,464 a year.

So, what does it take to join the 1% club? To be successful, understand that it is about more than earning a high salary. You’ll need to think and act strategically, employ effective financial planning and diversify your income streams. Many of the UK’s highest earners supplement salaries with business income, including partnership, dividend income and self-employment income. These are taxed more favourably than employment income. So while aiming for higher-paying roles is a good start, starting an entrepreneurial venture through a side hustle or business might be needed to break into the top 1% of earners.

Finally, as your income grows, make sure you are implementing strategies to build sustainable wealth through savvy planning and investing.