A GIF of a flying cat with a Pop-Tart for a torso.

The Charlie Bit My Finger video.

The first Twitter tweet.

What do they have in common? They are all NFTs (non-fungible tokens) that investors are buying for up to $69 million each. But what on earth is an NFT?

NFTs are a fairly new phenomenon that has been around since around 2014. They’re unique digital assets that you can buy and sell online using cryptocurrency. These unique tokens show others that you own a particular digital item (often a digital artwork). NFTs are disrupting markets around the globe from art to gaming and music.

Confused? Don’t worry! We’ve put together this guide to break down everything you need to know about NFTs. Let’s dive in!

What does NFT mean?

Firstly, NFT stands for non-fungible token. Now let’s start at the very beginning; what does non-fungible mean? “Fungible” is an economic term that refers to an asset that can be exchanged for another asset of equal value. For instance, a pound coin is fungible, because you can easily swap it for someone else’s pound coin.

In opposition, if something is “non-fungible”, it means you can’t swap it for someone’s asset of equal value. For example, a tract of land would be non-fungible. Since land is unique, finding another tract with the exact same value would be near impossible. Art is another example of a non-fungible asset since its value is highly subjective. This is where NFTs come in.

What do NFTs do?

As mentioned above, an NFT shows a person has exclusive ownership of a particular digital asset.

So simply put, NFTs are digital contracts that act as digital certificates of authenticity for unique digital files. You can create an NFT for any digital file, such as art, music, video, photo, or GIFs. At the time of writing, most NFTs are held by owners on the Ethereum blockchain.

Because NFTs allow the authenticity and ownership of digital files to be verified directly from the blockchain.

At the same time, the sale of digital products is facilitated because third parties, such as banks, are not needed as payment intermediaries.

In 2017, NFTs surfaced in the media as the internet went crazy about CryptoKitties. This is a game where you could buy, sell, collect and breed digital cats. Fast-forward to March 2021, the famous art auction house Christie’s sold the most valuable NFT in history (so far). It was a collage by an artist known as Beeple and it sold for a jaw-dropping $69 million.

Examples of Notable NFTs

Here’s a selection of some of the most notable NFTs out there:

- Kings of Leon released their latest album as an NFT in March 2021, becoming the first band to do this. With the release, the band raised more than $2m in sales revenue.

- The viral internet YouTube video ‘Charlie Bit My Finger’ was removed from YouTube and then sold as an NFT for $693k.

- Nyan Cat aka Pop Tart cat meme sold for $590k.

- The co-founder of Twitter, Jack Dorsey, sold his first tweet which read ‘just setting up my twttr’ for nearly $3m.

- A picture of a Shiba Inu named Kabosu, known for the iconic Doge meme, sold for a record-breaking $4 million worth of Ethereum.

Why do people buy NFTs?

Now you know what NFTs are, but, why the CryptoKitty would someone pay millions for one? Simply put, their reasons are often like buying something like Pokémon cards or a piece of art. In addition to letting you support artists or projects you like, scarcity and collectability are often some of the main reasons NFTs are attractive.

Collectability

Like swapping Pokémon cards on the playground, NFTs are essentially online trading cards (some of them for the mega-rich). While there isn’t always inherent value in these cards other than what the market ascribes to them, their fluctuating worth makes their collectability and trading potential like a high-risk game. Consequently, it’s easy to make comparisons between the NFT and the art market.

However, unlike the art market, NFTs give artists more autonomy as they don’t have to rely on galleries or auction houses to sell their work anymore. By cutting out the middleman, artists can sell their artworks directly to buyers and avoid sharing the profits.

Scarcity

When it comes to collectables, there’s nothing like a perceived sense of rarity to increase market interest in a particular item. As NFTs can only have one owner, they naturally create this sense of scarcity for buyers.

Think of it like when you find a pair of trainers you want to buy and the site tells you that there’s only ‘one pair left’. If you’re like most of us, this increases your sense of scarcity and encourages you to commit to making the purchase even if it doesn’t make financial sense. In fact, scarcity is often an intentional ecommerce and retail psychology trick that stores use.

The combination of scarcity and collectability culminates in an indestructible force called FOMO (fear of missing out).

How do NFTs differ from traditional authenticity certificates?

Although NFTs are a new technology, the value of collectables is far from it. Take Pokémon cards and the artwork of Andy Warhol, a pioneer of the famous pop art movement as an example. They are both highly popular collectables, the buyer will have to rely on a third party – such as an art expert – to assess the authenticity of the collectables.

Andy Warhol's art vs NFTs

Warhol’s art has been the subject of speculation for many years, with the authenticity and origin of the works being questioned. Warhol’s art can be certified as genuine and original either by a certificate of origin or by obtaining approval from the Andy Warhol Art Authentication Board. When evaluating the authenticity of an artwork, the Board considers things such as particular aesthetics, composition, signature, size of the work, the ink used, paper, stamps, and date.

There are more than 100,000 Warhol prints in circulation and they have been counterfeited numerous times over the years.

At the peak of his popularity, Warhol used his assistants to make the work in order to increase productivity. Warhol only put his own wooden mark on the works in the end, and so the art was magically made by Warhol! Warhol’s art has thus been prone to outside influences, which has made it possible to make counterfeits of the priceless original pieces. Because of the skilled counterfeits, experts suggest many of Warhol’s works around the world could be counterfeit.

When it comes to an NFT, important information about authenticity and originality is found directly in the blockchain, eliminating the need for a third party as an authenticity assessor.

Pokémon card example

So what about Pokémon cards?

In my own childhood in the 90s, ownership of Pokémon cards changed at a rapid pace, and there was rarely accurate information about the former owners or origins of the cards. Along the way, many cards were lost and destroyed, but you could always buy a new collectable package from the store.

There is a lot of money circulating among Pokémon card collectors, but there are also some fake cards. Recently, a YouTube star Logan Paul bought a rare $2m Pokémon card for $150k and thought he had got a great deal. However, the collectable was revealed to be a fake.

Unlike Pokémon cards, the purpose of an NFT is to prove the authenticity and ownership of a digital and irreplaceable file. However, it’s worth noting that NFTs can also be copied by anyone. In fact, scammers have made millions of dollars duplicating popular NFT artworks, memes and GIFs.

If the original creator of the work has disappeared or information about them has been left under copies of the work, an NFT can be used to ensure that the ownership information of the original digital file is preserved and verifiable in the blockchain for everyone to see.

Through the example provided by both Warhol’s art and Pokémon cards, we can now understand why NFTs are useful both for proving the authenticity and verifying ownership.

Is it worth investing in NFTs?

Before you buy an NFT, make sure you understand the risks. NFTs are another facet of the recent crypto boom. As a result, the biggest risk when buying NFTs is the volatile and unpredictable nature of the market. Scamming is also a common problem in the NFT market. With these in mind, thorough research is required before investing in NFTs.

On the other hand, for a high-risk investor, NFTs can offer a unique, high-stakes opportunity to make some big profits. But as with cryptocurrencies, nothing is guaranteed due to the volatility. Although not as sexy or flashy, if you’re looking for a more reliable way to invest your money, investing in index funds is likely to be a better option for you.

However, if you have some extra money and already have your personal finances in order – including a more stable long-term investment strategy – NFTs could be something to look into.

How can I buy NFTs?

The first thing you will need to start buying an NFT is a crypto wallet. This will be used to send, receive and store digital assets. MetaMask and Coinbase Wallets are some of the most popular crypto wallets you can use for this.

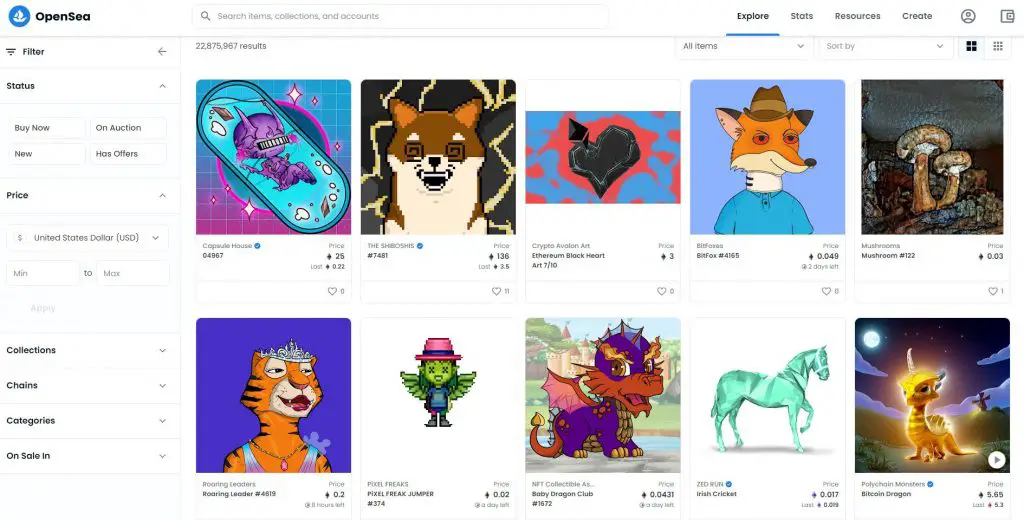

NFT marketplaces let you connect your wallet to their platform and start trading. Someone looking for their first NFTs can head over to one of the larger marketplaces, such as OpenSea or Rarible. These platforms are so-called secondary marketplaces where you can buy these collectables from other NFT investors.

Ensure your wallet balance contains some Ethereum (ETH) to cover the network’s transaction fees (also known as gas fees). These fees can rise quickly when the Ethereum blockchain is particularly busy.

Finding the best new NFT is often a case of following relevant social media forums or keeping a close eye on marketplace announcements like Nifty Gateway on Twitter.

A good NFT could be artwork from a known artist, any popular pop-culture meme or a digital asset in a video game. Anything you think will remain in demand over time is a good start for a purchasing decision.

Although we’ve introduced some high-profile NFTs in this article, in reality, NFTs come in all price ranges. See below an example of some NFTs on sale in OpenSea in October 2021.

How do you mint an NFT?

Buying NFTs from the secondary market (i.e. where the assets have had a previous owner) can be the easiest option for a beginner. However, minting new NFT projects can offer significantly higher profits when reselling.

For example, take the recently launched Jungle Freaks project by cartoonist George Trosley. The mint price was 0.07 ETH (approximately $300) and the secondary price immediately afterwards on OpenSea was 0.8 ETH. That is an instant profit of 11x investment.

This may sound like easy money, but there’s always a catch. To be able to purchase at that price you would have needed to know about the project early and make it onto the coveted ‘whitelist’. Otherwise, you were left in the trenches fighting against hundreds of thousands of people for a spot in the general sale. On this battlefield, just the gas prices reached a height of over $5,000.

So, how does the savvy investor make it onto the whitelist? The key thing is, as previously mentioned, to be in the networks where these projects are announced early.

Another interesting tool is rarity.tools which has a section that allows you to see up-and-coming projects that are about to launch. There can be lots of these launching and most projects will fail. Therefore, the selection is critical. One easy way to screen them on rarity.tools is to check how many members are active in Discord. If this is above 30,000 before the project has even launched, then it is worth researching further.

How do you avoid scams when buying NFTs?

It’s absolutely important that you read this section if you’re considering buying an NFT. As with all good things in life, success breeds a desire for a piece of the pie. For some unscrupulous individuals, this takes the form of unfairly relieving you of your assets. Scamming is currently a huge problem within the NFT space. Before making any purchase or approving any transaction make sure you are 100% sure that you are buying from the collection’s true owners.

Here are some ways you can verify the legitimacy of a collection:

- On OpenSea, there will be a blue tick next to a collection that is verified. You will see many others (for popular collections) that do not have the tick that is created fraudulently. However, for new collections, it will take some time to receive a blue tick so it may not be present.

- You should also look at the number of mints within a collection. This should correspond to how many of the pieces are in existence. This varies for each collection, but It will usually be a large round number like 10,000 or 5,000. If you have researched the project you will know what this number is.

- Find the authorised social media channels of the project and only follow links posted there. Scammers will go to the length of creating new discord accounts or social media channels. They will use these as a launchpad for fake websites and links where you believe you’re buying an authentic NFT and you receive nothing.

- If something is too good to be true, question it. It can be tempting within the NFT space to rush towards purchasing something because of the competition and scarcity. Do not let the FOMO rush you towards losing your money.

Conclusion: Are NFTs worth it?

NFTs are an exciting new development in the digital space that can be both risky and rewarding. You’ve now learned the basics of NFTs, why they’re valuable and where you can buy them.

For a savvy investor with a high appetite for risk, NFTs can form part of a diversified portfolio of assets. If you choose to buy, make sure you always purchase from an approved source to protect your funds.

Please note that this article is for educational purposes only. We never give investment advice. Always do your own research and invest in your own risk tolerance.

Wow! Great article. Very thorough. I now have a better understanding of NFTs. Thank you for sharing.

Thank you, it’s good to hear you found it useful!

Very interesting, my brother was trying to explain NFTs to me and I could not understand. This is much more helpful!

Thanks for your comment – I’m glad you found this NFT guide helpful! 🙂

Wow, this is so interesting! I had heard about things like this selling, but had no idea how you went about selling or buying them. Thanks for teaching me something today!

Very informative. Now i have a fair idea about NFT. Thanks for sharing your knowledge.

Great post! NFT can be a little difficult to understand but this article made it easy to understand.

I was curious what it was, I never heard of it before. Thanks for the interesting article.

Thanks! I hope this helped to explain what NFTS are 🙂

This is a very informative post. I have heard of NFTs, but wasn’t quite sure what they were exactly. Thanks for the details and education.

Thank you, I’m glad this helped you to learn more about NFTs!

A very informative read. I like the flow of ideas.

I had not really paid attention to learning what NFTs are all about. But through this article I now know what NFTs are.

Really well written, honest article. I have been struggling to fully understand NFTs for some time.

Very interesting read thanks for sharing such a torough article

I have listened to Tom Bilyeu speak a lot about NFTs. I’m not entirely convinced yet, but I am interested.

Lots of info here! I haven’t heard of NFT until I read this. I can see how the risks are great, but the rewards can be great, too!

Never heard of an NFT before reading this. Mind blown. Great post.

Hello I’m learning haven’t got it down yet but imma keep picking at it✊🏿💪🏾👌