Tax forms can seem confusing, but understanding a few key documents can empower you to manage your finances effectively. This guide focuses on two essential PAYE forms – the P45 and P60. Whether you’re starting a new job or simply want a clearer picture of your tax situation, knowing the difference between these forms is useful. This simple guide will explain the key differences between the P45 vs P60 forms and what they are used for.

In simple terms, here’s how P45 and P60 forms are different:

- A P45 shows how much tax and National Insurance was paid for you by your employer (PAYE) for the tax year – up until the date you left that job

- A P60 shows your total earnings and tax paid for the entire tax year, including how much tax and National Insurance were deducted.

What is PAYE?

PAYE stands for Pay As You Earn. It’s a system in the UK where your employer automatically deducts income tax and National Insurance contributions from your salary before you receive it. This ensures you make tax payments throughout the year, rather than receiving a large bill at the end.

Here’s a breakdown of how PAYE works:

- Your employer reports your earnings to HMRC: They submit information about your salary, bonuses, and other taxable income to HMRC (HM Revenue and Customs).

- HMRC calculates your tax code: This code determines how much tax and National Insurance is deducted from your paycheck. It considers factors like your personal allowance (the amount you can earn tax-free), other income you might have, and any tax relief you’re entitled to.

- Your employer deducts tax and National Insurance based on your code: They withhold the calculated amount from your gross pay (your salary before deductions) and send it to HMRC on your behalf. This code considers factors like your personal allowance, other income you might have, any tax relief you’re entitled to, and the value of taxable benefits you receive.

- You receive your net pay: This is your salary after taxes and National Insurance have been deducted.

P45 vs P60: What’s the difference?

The P45 and P60 are some of the most common tax forms that employees need. They play a crucial role in ensuring PAYE functions smoothly:

- P45: When you leave a job, your previous employer provides you with a P45. This form details your earnings and tax deductions up to the date you left. Your next employer uses this information to determine your tax code. They will then start deducting the correct amount of tax from your new paycheck.

- P60: At the end of each tax year (April 6th to April 5th of the following year), your current employer sends you a P60. This form summarises your total earnings and tax paid for the entire tax year. It serves as a record for you and may be needed for specific tax purposes.

What is a P45?

Think of the P45 as your “report card” from your previous job. It is issued at the end of your employment, detailing necessary information about your earnings and taxes up to that date. This information helps your new employer apply the correct tax code and ensure you’re taxed accurately from the start. You should hand over your P45 as part of the starter checklist or onboarding process.

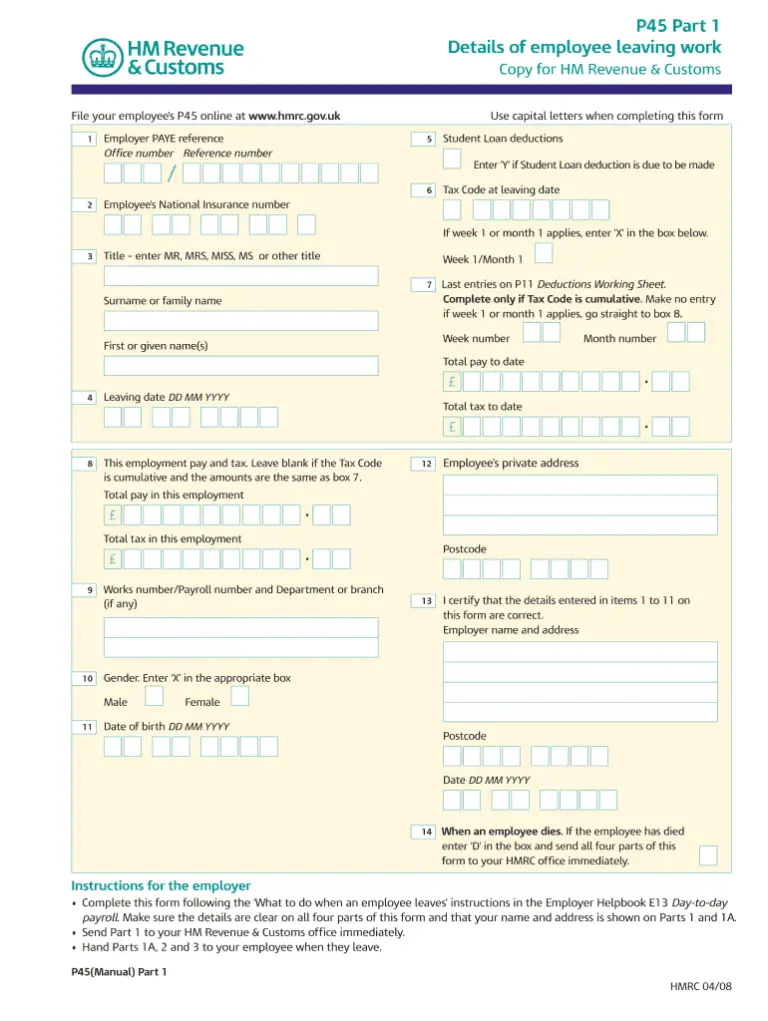

What information is on a P45?

Your P45 typically includes:

- Your personal information (name, National Insurance number, etc.)

- Your previous employer’s information

- Your total earnings up to the date you left the job

- The amount of tax and National Insurance already deducted from your salary

- In some cases, your emergency tax code (if applicable)

How to get a P45

To get a P45, you need to be leaving – or have recently left – your job. Your former employer has a legal obligation to provide you with a P45 when you leave your job. If you haven’t received one, politely ask your previous employer for it.

How long is a P45 valid for?

P45 is only valid for the specific tax year it’s issued in (6th April to 5th April of the following year). However, HMRC recommends keeping it in a safe place for at least 22 months after the end of the previous tax year. This allows you to verify your earnings and tax information if needed. You might also want to keep it longer for potential tax investigations – HMRC has the right to carry them out up to 20 years after the point in question.

What is a P60?

The P60 is a form you get from your current employer at the end of the tax year (usually around April). This end of year certificate details your total pay for the entire tax year, along with the amount of tax and National Insurance deducted. While not directly related to P45s, it serves as a valuable record for you. You might also need it for purposes like claiming tax credits or applying for a mortgage. HMRC recommends keeping your P60s for at least six years.

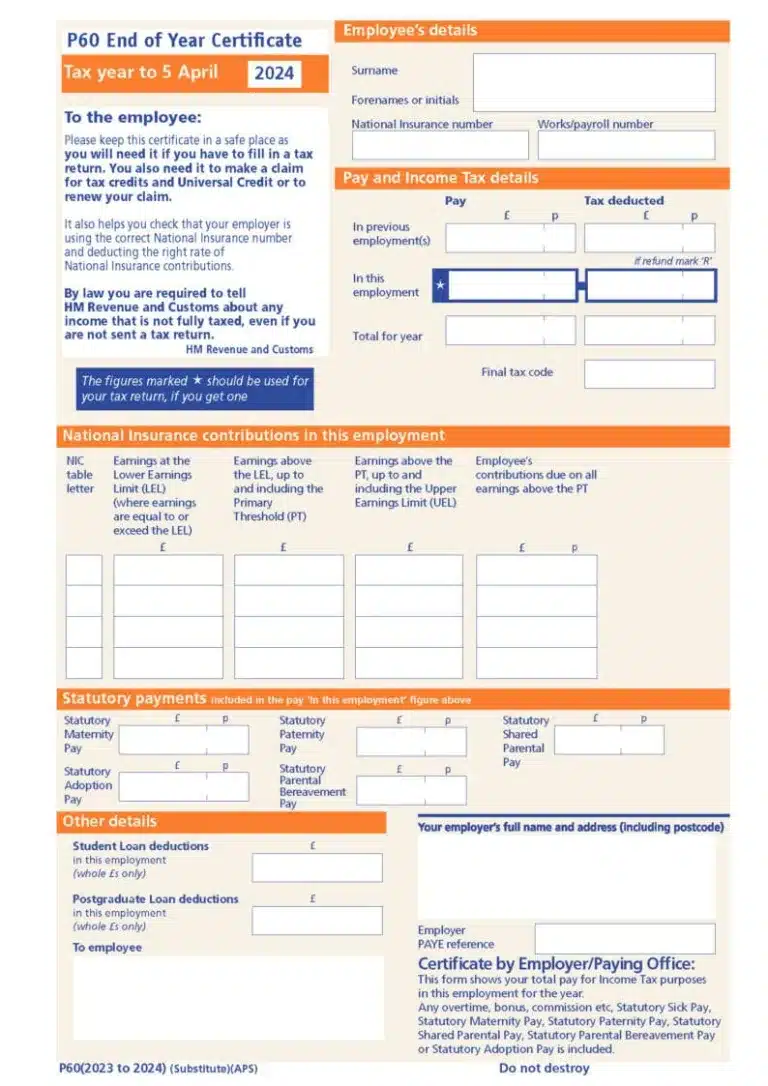

What information is on a P60?

Your P60 typically includes:

- Your personal details (name, National Insurance number, etc.)

- Your current employer’s information

- Your total earnings for the entire tax year (April 6th to April 5th of the following year)

- The amount of tax and National Insurance contributions deducted from your salary throughout the year

How to get a P60

Your current employer has a legal obligation to provide you with a P60 automatically every year, usually by May 31st. Your employer typically shares the form the same way as your payslips, e.g. via email or payroll software. If you haven’t received one by then, it’s best to check with your payroll department or HR representative. They can then investigate the issue and ensure you receive your P60 promptly.

How to get a copy of P60

If you lose your P60 or otherwise need a copy, ask your employer for a replacement. If you cannot get a replacement from them, you have two options: You can use your tax account on the HMRC website to view or print the information that was on the P60. Alternatively, contact HMRC and ask for the information that was on the P60.

Where else do I need a P45 or P60?

While starting a new job is the most common situation where you might need a P45 or a P60 form, there are other instances where these forms can be useful:

P45:

- Claiming benefits: If you’re claiming unemployment benefits (Universal Credit) at Jobcentre Plus, they might require your P45 to verify your earnings and tax history.

- Tax adjustments: If you believe your tax deductions haven’t been accurate, you might need your P45 to provide evidence to HMRC for potential adjustments.

- Self-employment: If you become self-employed after leaving a job, your P45 can help determine how much tax you need to pay through self-assessment.

P60:

- Tax return: If you need to file a self-assessment tax return, your P60 can help verify your income and ensure your return is accurate.

- Applying for a mortgage or loan: In addition to recent payslips, some lenders or financial institutions might request your P60 to assess your total income and affordability for a mortgage or loan application.

- Verifying income: In specific situations, you might need proof of income for various purposes, and your P60 can serve as a verified record if required.

P45 vs P60: The key differences summarised

Navigating new paperwork can be overwhelming, especially when starting a job. Two important forms you might encounter are the P45 and P60. Let’s recap the key differences between these two tax forms:

| Feature | P45 (Job Change Companion) | P60 (Annual Tax Summary) |

|---|---|---|

| Issued by | Previous employer | Current employer |

| Issued when | You leave a job | End of tax year (around April) |

| Timeframe covered | Up to the date you leave your job | Entire tax year (April 6th to April 5th of following year) |

| Information included | Earnings, tax, National Insurance (up to leaving date) | Earnings, tax, National Insurance (for entire tax year) |

| Purpose | Helps your new employer tax you correctly | Provides a record for you (may be needed for tax purposes) |

| Student loans | Not shown | Not shown |