Did you know that the average middle-class American need to save at least $1 million to retire comfortably? This and various other intriguing money facts have been revealed in the Netflix mini-series Money, Explained.

The five-episode docuseries makes complicated personal finance topics like retirement savings and student loans entertaining and understandable for casual viewers. It talks about money and its many minefields, from credit cards to gambling and ‘get-rich-quick schemes’.

Although Money, Explained is very heavily documented from an American point of view, it can provide some essential money lessons regardless of where you live. If you haven’t watched the series yet, read on to learn the five key learnings I’ve picked from Netflix’s Money, Explained. I’ve also included my take on some actionable tips you can do on the back of these money lessons.

1. Beware of scams promising you to get rich quick

Scrolling through social media, there are many people promising to tell you the secrets of getting rich quickly. These might sound like an obvious thing to avoid but people continue to get scammed by companies and individuals promising immediate riches. Whether it was a coaching programme, advance payment scam or pyramid scheme, get-rich-scheme scams have become increasingly common.

So why do we still fall for these scams?

While these schemes are getting more common, at the same time, they are also getting more clever. Hence it’s increasingly difficult to spot a scam. According to Money, Explained, most of us think we’re good lie detectors but we’re not. In fact, we’re actually wired to trust other people. Therefore, this makes everyone susceptible to becoming a victim of a scam.

In addition to this, the age of social media has taught our brains a desire for instant gratification and the dopamine rush of attention online. The same applies to the desire for instant results, whether it was about getting rich, fit or successful.

Related: What is MLM makeup & can you really make money in an MLM?

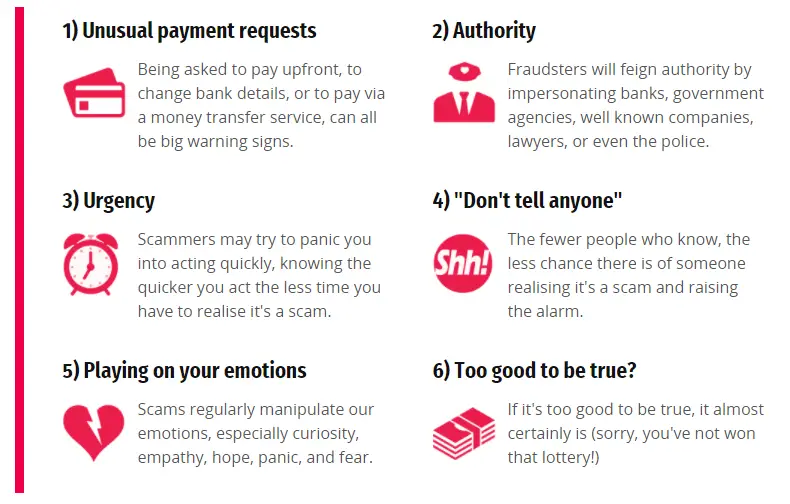

So how can we avoid taking on the bait? Here are some common characteristics of online scams to look out for:

- Advance payment with no cancellation policy or unconventional payment methods

- Authority to build your trust

- Sense of urgency

- You might be asked for confidentiality

- Playing with emotions

- The offer sounds too good to be true

While it’s important to aim to avoid any get-rich-quick scams online, it’s equally important to report them if you become a victim. Based on the documentary, it’s estimated that only 20% of fraud victims tell others they’ve been a victim of fraud. Meanwhile, as many as 40% don’t tell anyone, not even friends or family.

2. Use your credit card smartly

Credit card companies make most of their money from three things: interest from users, fees charged to cardholders and transaction fees paid by businesses that accept credit cards. By using your credit card wisely, you can minimise the amount of money that credit card companies make off of you.

As stated in Money, Explained, people who pay off their credit card bill in full every month are called transactors. Meanwhile, a revolver is someone who doesn’t. The documentary suggests that 40% of Americans are revolvers, 40% are transactors and 20% don’t have a credit card at all.

Paying your credit card bill in full each month is by far the best way to avoid additional fees or interest. Therefore, you will want to aim to belong in the first 40% of the transactors. Here are some further dos and don’ts for smart credit card usage:

- Set up a monthly direct debit so that you will never forget to pay your bill on time. This way you will also avoid paying any interest.

- Use your credit card to build up your credit score and to earn perks and rewards.

- Use your credit card like a debit card: don’t buy things you couldn’t otherwise afford.

- Avoid using your credit cards to cover emergency expenses, build an emergency fund instead.

- Don’t exceed your credit limit. Constantly going close to your maximum limit may also damage your credit score.

- Don’t withdraw cash with a credit card.

- Avoid applying for too many different credit cards.

4. Day trading is gambling rather than investing

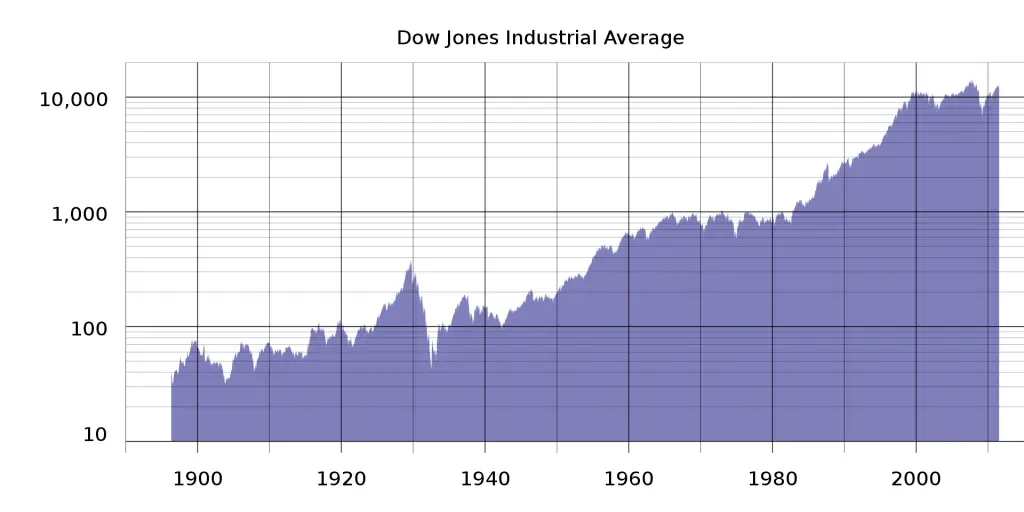

Investing is important to beat inflation and build long-term wealth. However, many people are trying to time the market by day trading in hope of instant rewards and riches.

Day trading refers to buying and selling a security within the same day. It’s most commonly done in the foreign exchange (forex) and stock markets. Day trading can be a lucrative career for an investment professional when done properly. However, Netflix’s Money, Explained suggests that for an average individual investor without a proper strategy, day trading is like gambling. It’s also worth noting that even the most seasoned day traders can hit rough patches and experience losses. This is because in the short-term, such as a single day, it can be a real roll of the dice how the market performs.

So how to invest then?

In the long run, the market has always gone up. So the longer you let your money sit in your investments, the more likely you are to come on top. Although long-term investing is not a way to get rich quickly, it’s a guaranteed way to build wealth over time.

To learn more about long-term investing and how to get started, read my article 5 Powerful Reasons Why Investing Your Money is Important.

4. Don't ignore retirement savings when you're young

In all of the world’s major economies, life expectancy has increased in the past decades. Although people living longer is generally good for the economy, longevity comes with challenges. The World Economic Forum’s report quoted on the document suggests retirees around the globe will outlive their savings, leaving many facing an uncertain future.

The ageing population has placed unsustainable pressure on the government and employer-sponsored pension systems. This has led to a growing trend for individuals to take responsibility for financing their own retirement. However, people’s savings have failed to keep pace with the decline in traditional pension plans. With the current saving habits, many people will sink from a middle-class life to a near-poverty experience into retirement.

So why are people not saving enough?

Money, Explained suggests that psychologically, people don’t identify with who they’ll be in the distant future. This has a big part to play in the reason why people are not motivated to save for retirement. People rather spend money now on things providing instant gratification instead of prioritising long-term financial rewards. It’s much easier to get excited about having new shoes or a car now than having a comfortable retirement in the future.

Unfortunately, instant gratification doesn’t take us far in life. Enjoying the here and now is of course important for a happy life. But saving and investing is essential for long-term money success that allows you to have a comfortable life in your retirement too.

How can I save $1 million by retirement age?

As mentioned at the beginning of this article, the average middle-class American needs to save at least $1 million to retire comfortably. This might sound pretty scary – but it doesn’t have to be. This is when workplace pension, investing and the power of compound interest can help you massively to reach this goal.

Let’s look at an example showing the importance of investing as part of retirement savings.

Say you’re 30 years old and want to reach the $1 million goal by saving money in your bank account by the time you’re 65. This means you would have to save a whopping $2381 every month until you retire!

But if you followed an investing strategy instead, you would only need to invest around $555 per month to reach $1 million in 35 years. This is calculated based on investing in a low-fee index fund with an average annual return of 7%.

Final thoughts: Key learnings from Netflix’s Money, Explained

Whether you are interested in personal finance topics or not, the themes covered in Money, Explained are something that affects us all. The show is an easy and interesting way to learn about complex money topics in bite-sized episodes during which you don’t have time to get bored. But unlike most other shows you watch on Netflix, you will likely want to take action to secure a better financial future for yourself after watching this docuseries!

The one key theme around most of the learnings I picked up from Money, Explained is the importance of long-term thinking against short-term gratification when it comes to money.

Comment below if you have seen the documentary and let me know what was the most eye-opening fact or learning you got from it! 🙂

Related:

7 Money lessons from Netflix’s Squid Game

I heard about this and would like to watch it next week on Netflix. Also I might practice one of the methods to see if it’s effective for me 🙂

Thanks for your comment! I’d highly recommend both watching it and taking action towards long-term money success 🙂

Very Interesting, I am definitely going to watch this. I have always been very frugal and saving money has always been a priority for me. We have planned well for our retirement.

That’s great to hear, thanks for your comment Michelle! 🙂

I watched a portion only and yes very informative. Now Im keen to watch the rest.

Glad to hear you found it informative, I’d definitely recommend watching the rest too 🙂

Great post. I will definitely check this out. And few of my friends do day trading which I felt was great, but now i am clear that that’s just gambling. I would never like to get into that.

Thanks! Like with gambling, you don’t necessarily lose all your money by doing it so it’s not necessarily all bad if you know what you are doing. However, the data shows that long-term investors are proven to be more successful over a longer period of time than those trying to time the market by day trading 🙂