No investor, novice or expert, is immune to the occasional misstep. But these common investing mistakes hold powerful lessons within. By learning to identify and avoid them, you’ll build a resilient portfolio that can weather any financial storm. This guide isn’t meant to hold you back but to equip you with the knowledge and strategies to navigate the investment landscape confidently. Get ready to outsmart the market and watch your money grow!

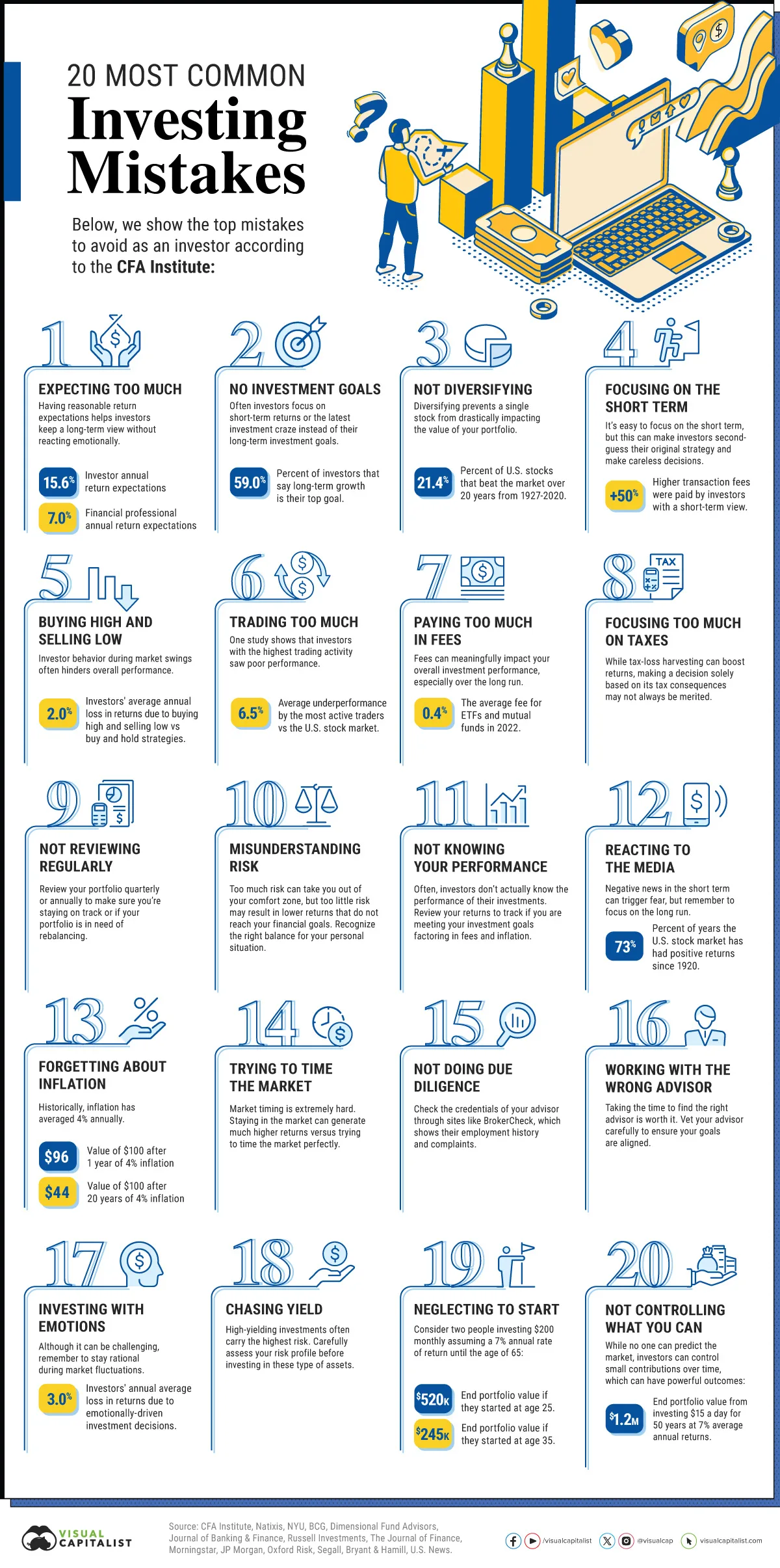

20 common investing mistakes to avoid

When learning how to invest, it is important to learn from the best, but it also pays to learn from the worst. That’s why we are covering the top 20 common mistakes in investing, according to the CFA Institute. We will also give you tips on how to steer clear of these pitfalls and build a successful portfolio.

1. Expecting too much

Building a long-term investment portfolio is like setting sail on a long voyage. You plan your route, pack supplies, and choose a sturdy ship – but the seas will always bring surprises. It’s smart not to expect smooth sailing every day, and to adjust your expectations as the winds change. Remember, nobody has a crystal ball for future returns. The key is to build a flexible, well-diversified portfolio that can weather any storm and fit your unique goals and risk tolerance.

2. Not having clear goals

Investing without goals is like driving without a map. Get clear on your long-term dreams, such as retirement, financial freedom, or travel – and build an investment plan that takes you there. Ditch the fads and focus on achieving your goals, not just making quick profits.

3. Failing to diversify

Imagine balancing all your eggs in one basket. One bumpy road, and they’re all scrambled! That’s what can happen when you invest too heavily in one stock or sector. Diversification is like spreading your eggs across multiple baskets – even bumpy roads won’t crack all of them. Spread your investments across different baskets to build a portfolio that can handle any market surprises. One simple way to do this is to focus on investment funds instead of individual stocks.

4. Focusing on the short term

Forget market noise. Long-term investors stay focused on the big picture. Ignore short-term swings and nurture your investments with a patient, long-term vision. If you find yourself getting caught up in the daily drama, take a deep breath, refocus on your goals, and remember: true wealth takes time.

5. Buying high and selling low

The “buy low, sell high” dream becomes a nightmare when emotions take the wheel. Instead of chasing temporary hype, shift your focus to the long game. Prioritise your individual goals and risk tolerance, then build a diversified portfolio based on solid fundamentals, not market whispers. When uncertainty hits, don’t panic. Step back, re-evaluate your strategy, and remember, the path to lasting wealth rarely involves following the crowd.

6. Trading too much

Investing isn’t a sprint, it’s a marathon. The best rewards often bloom with time, not impulsive tweaks. Constant portfolio tinkering may seem tempting, but it can eat into your profits through fees and trap you in unexpected risks. In fact, it’s been widely estimated that up to 95% of day traders ultimately lose money. Before hitting the “trade” button, pause and reflect. Is this a calculated move or a knee-jerk reaction? Use your urge to change as a chance to deepen your understanding of your existing investments, not just shuffle them around.

7. Paying too much in fees

Investing success isn’t just about picking the right stocks or funds; it’s about protecting your wealth from unseen threats. Fees can be like silent thieves, stealthily chipping away at your returns over time. Avoid this common investing mistake by being a vigilant guardian of your money. Compare fees meticulously, demand demonstrable value for any advice, and choose options that prioritise your financial well-being. Remember, cost-effective choices pave the path to a thriving portfolio that truly works for you.

8. Focusing too much on taxes

While taxes can influence investment decisions, they shouldn’t be the main driver. Choosing investments solely for tax benefits can backfire. Focus on quality assets with strong potential, like those in tax-advantaged accounts like Roth IRAs (US) and Stocks and Shares ISAs (UK).

Related: Best self-select Stocks & Shares ISAs for individual shares

9. Not reviewing investments regularly

Even the best portfolios need adjustments. Don’t let yours drift – check in regularly, at least once a year, to ensure your investments still fit your goals and rebalance if needed. It’s a quick pit stop on your path to financial success!

10. Taking too much, too little, or the wrong risk

Investing is a balancing act: potential reward on one side, risk on the other. Overdo the risk, and your portfolio might do acrobatics you didn’t sign up for. Play it too safe, and your returns might barely inch forward. Find your sweet spot, where risk and reward meet comfortably, aligned with your goals and risk tolerance.

11. Not knowing your performance

Blindfolded portfolio? No thanks! It’s surprising how many investors fly on autopilot, clueless about their overall performance. Knowing a few stock prices or headline numbers isn’t enough. Zoom out, see the big picture, how your entire portfolio is performing. Relate its performance to your plan, factoring in costs and inflation. This reality check keeps you on track. Wouldn’t you want to know if you’re hitting your financial goals?

12. Reacting to the media

The 24/7 financial news cycle bombards you with “tradable” tidbits, tempting you to react impulsively. But hold on! Smart investors know most news is old by the time it reaches your ears, already baked into market prices. Ditch the “hot tip” trap and cultivate your own information garden, drawing from diverse sources and your own meticulous analysis. That’s the key to making informed, long-term investment decisions, not chasing fleeting headlines.

13. Forgetting about inflation

Focusing on nominal returns instead of real returns is a common investing mistake. Many investors get fixated on seeing growing numbers on their statements, but true financial success depends on something else: how much you can actually buy with your money. It’s not just about raw returns, but about what your money can do in the real world after fees and inflation have had their say. Even when the inflation is not very high, these costs can slowly chip away at your buying power. Instead of just watching the numbers climb, make it a habit to adjust for rising costs so your money keeps up and you can buy even more in the future.

14. Trying to time the market

Market timing is technically possible but often not worth the effort. Missing just a few key days can tank your returns. Consider this: staying out of the top 10 S&P 500 days between 1993 and 2013 cost investors nearly 4% per year. Smart move? Stick to consistent investing, your wallet will thank you.

15. Not doing due diligence

Handing over your hard-earned money is a big deal. You probably wouldn’t want health advice from a doctor with no qualifications. So why not do the same for your finances? It’s easy to be swayed by smooth talk, but don’t let charming personalities distract you. Do your homework! Databases and references are your tools to avoid potholes and scams. Dedicate a few hours, and sleep soundly knowing you’re in the driver’s seat of your financial future.

16. Working with the wrong advisor

Finding the right financial advisor isn’t a quick pit stop, it’s an investment in your future. Sure, a hasty decision might offer temporary comfort, but a true partner will be with you every step of the way, helping you weather market storms and celebrate milestones. Their skills and shared values will be your compass, leading you to financial stability and peace of mind for years to come.

17. Letting emotions get in the way

Investing can be an emotional rollercoaster and making financial decisions based on emotions is a common investing mistake. Fear of missing out can lead to hasty decisions, while worry about the future can make us freeze. Even questions about family involvement or legacy planning can cloud our judgment. But remember, our emotions don’t always make the best financial advisors. Remember, successful investing often comes from being aware of your emotions and making rational decisions, not letting them drive the bus. With a clear head and a solid plan, you can navigate the ups and downs of the market with confidence, regardless of what life throws your way.

18. Chasing yield

A high-yielding asset is undeniably alluring. Why not aim to maximise returns? However, it is important to remember that past performance does not guarantee future results, and the allure of high yields often coincides with elevated risks. Keep your focus on the comprehensive picture; avoid distractions by prioritising effective risk management.

19. Neglecting to start

One of the most common investing mistakes? Not starting at all. While analysing, researching and planning have their place, getting stuck in endless loops can leave your money gathering dust. Remember, investing isn’t a masterclass in astrophysics – it’s a journey of continuous learning and consistent effort. So, let’s stop overthinking and start investing! Take that first step, learn along the way, and watch your financial future come alive.

20. Not controlling what you can

People like to say that they can’t tell the future, but they neglect to mention that you can take action to shape it. Building wealth is about steady action, not crystal ball predictions. Every little bit you invest today adds up, snowballing your future with compound interest. It’s the slow and steady wins the race, not the impulsive guesswork. Ditch the guessing, invest consistently, and watch your goals get closer with each step.

Conclusion

We’ve explored the top 20 common investing mistakes, but let’s be honest, the biggest one sometimes lurks silently: not investing at all. Hesitation and inaction can be just as damaging as impulsive decisions. This guide wasn’t meant to overwhelm you, but to show you that informed action trumps fear. By avoiding these pitfalls, you’ll be well on your way to achieving your financial goals. So, embrace the journey, learn from the missteps of others, and invest in your future!