First-time home buyers in the UK will be seeing some changes in the property market and home purchase initiatives in 2021. If you are aiming to get on the property ladder this year, read through these four changes to understand how they might affect you.

Help to Buy scheme is changing

The government’s Help to Buy equity loan scheme supporting people to get on the property ladder is changing from 1st April 2021. But what does this mean for the new first-time buyers in the UK? Let’s discover below.

The new Help to Buy: Equity Loan (2021-2023) is a government programme which aims to help first-time buyers to buy residential property. Similarly to the current Help to Buy scheme, it’s a loan from the government that you put towards the cost of buying a new-build home. This allows you to borrow between 5% and 20% (40% in London) of the full purchase price of a newly build home.

While the current Help to Buy scheme is also available for home movers, under the changes coming to place in April 2021, the equity loans will be only offered to first-time buyers. In addition to this, the amount you can borrow will be capped according to the location of the home you are purchasing. To clarify, buyers can only use the initiative to purchase a home costing maximum 1.5 times the average first-time buyer property price in their region. You can find the price cap for your region below:

Price caps for first-time buyer Help to Buy homes by region

|

If you are a UK first-time buyer and want to use the new Help to Buy scheme, you can reserve your new home already. However, you cannot get the keys to move in until the new scheme officially start on 1 April 2021.

Further to being a first-time buyer, there are certain eligibility criteria that you will need to meet to purchase through Help to Buy after the changes to the scheme:

- If you are buying a property with another person, both of you must meet the definition of a first-time buyer. Please also note that if you are buying with a partner or spouse, you will need to apply jointly and ensure you both meet the credit criteria.

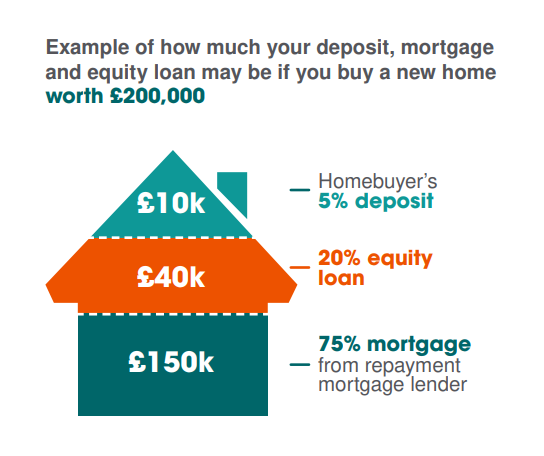

- While there is no minimum or maximum income brackets, you must be able to fund at least 80% of the purchase with a combination of deposit and mortgage. For instance, here’s an example for a new home worth £200,000:

Stamp duty holiday extended to June

Until 30 June 2021, first-time buyers only need to pay stamp duty land tax (SDLT) on properties costing more than £500,000, rather than £300,000. After June, the starting rate of stamp duty will be £250,000 until the end of September.

The SDLT thresholds across the UK was raised in 2020 as the government was aiming to spark the housing market into life amidst the Covid-19 pandemic.

The previous £300,000 threshold meant the vast majority of first-time buyers in the UK were already exempt from the tax, with the average first home price in England being at £208,000. This means the stamp duty holiday is only benefitting first-time buyers purchasing in more expensive areas or bigger properties.

If you are planning to buy a property costing more than £300,000 and are not in the process of purchasing it yet, it’s worth to start looking by June at the latest. This is because it typically takes a minimum of 6-12 weeks to buy a home. However, in many cases the process might take even longer so the more time you reserve for it, the more likely it is that you can complete before the September stamp duty deadline.

How does the sunset of stamp duty holiday affect first-time buyers in the UK?

The good news is that even after the stamp duty holiday is over, first-time buyers will still be

eligible for a relief. As a result, you’ll pay less or no tax if both the following apply:

- You, and anyone you’re purchasing with, are both first-time buyers.

- The home you are buying is £300,000 or less.

If the property costs between £300,001 and £500,000, as a first-time buyer you will only pay a reduced rate of 5% stamp duty on any value that exceeds £300,000. For example, if you are purchasing a property of £400,000, you’ll only pay stamp duty on £100,000.

More mortgage choices

The first-time buyer market has seen a strong start to 2021 as the number of mortgages available with a 10% deposit has increased to 248 in February 2021. This is great news for UK first-time buyers after many were locked out of the mortgage market during 2020 when lenders withdrew deals.

According to Moneyfacts.co.uk, first-time buyers will also find the average interest rates for 90% LTV (loan-to-value) mortgages are improving. The average 90% LTV mortgage rate is now 3.56% for a two year and 3.72% for a five year fixed deal. Furthermore, buyers with a 10% deposit are now also benefiting from more cashback offers in the market. Based on the latest analysis, mortgage deals with incentives increased from 50 to 83 between January and February 2021.

Although this is positive news and gives hope to first-time buyers, the average interest rates are still higher than pre-pandemic. As a comparison, early 2020 saw lows of 2.57% and 2.91% for two and five year fixed rates, respectively.

Another good news is that the government is going to incentivise lenders to provide residential mortgages with just 5% deposits. Although this will likely help many first-time buyers in the UK to step on the property ladder faster, it’s worth noting that the lower deposits usually mean higher interest rates.

House prices forecasted to fall

UK house prices rose by 8.5% in 2020 regardless of the pandemic. The property prices were pushed up partially due to the stamp duty holiday. However, it’s predicted that the end of the SDLT holiday in September could trigger a drop in house prices. In fact, the UK’s biggest mortgage lender Halifax is forecasting house prices to drop by 2-5% in 2021. On the other hand, the prices are likely stay stable or even continue increasing until the stamp duty holiday is over.

It’s of course difficult to forecast property prices accurately. But if these predictions turn out to be true, this is surely great news for UK first-time buyers. After all, lower prices naturally mean that you need to save less for a house deposit. Or alternatively, you could potentially afford purchasing a bigger property.

Conclusion: What does 2021 have in store for first-time buyers in the UK?

With unemployment expected to rise this year and lower levels of property demand after the stamp duty holiday ends, overall prospects for the 2021 housing market look much weaker compared to 2020. However, lower demand tends to lead to lower prices. This is obviously fantastic news for those UK first-time buyers whose finances haven’t been notable affected by the pandemic. More mortgage choices offered for buyers with 10% deposit can also further help first-time buyers get on the property ladder compared to last year. All in all, there is hope that 2021 sees more potential home-buyers take that first step onto the property ladder. If you are planning to buy a home this year and want an extra push to help you save for the deposit and fees, you might want to consider picking up a side income or making your savings work harder for you.

Nice breakdown of what is what all in one place, rather than trying to scour the Internet for this relevant info. I’d love for my son to get on the property ladder sooner rather than later so for his sake I’d be happy if the prices fall. At the same time, however, I have two properties that I let and I wouldn’t want the price to go down. Dilemma? Well, we continue to hope for the best and I’ll continue to hold on to these properties as part of my pension later on.

Thanks for your comment Joleisa, glad you found the post helpful! I have rental properties myself as well and since I’m not planning to sell them anytime soon either, the potential price drops shouldn’t really negatively affect us. Although house prices might see a drop after the stamp duty holiday (as that’s mainly inflating the prices at the moment), I’m sure long-term the prices will keep going up!