Climate change and the battle against it have a significant impact on the stock market and how companies operate. More and more people want to contribute to the fight against climate change through responsible investing and other sustainable ways to manage money. In fact, money has a crucial role to play in creating a more sustainable future. But how to invest responsibly and sustainably? And what are the things a responsible investor should consider? These are a few areas we’ll cover in this responsible investing article.

What is responsible investing?

Today many investors are turning to sustainable and responsible investing. According to studies, two out of three investors bear ethical issues in mind. But investing jargon around ‘environmental, social and governance’ can be confusing to investors. In fact, many investors admit they have little to no understanding of the terms often used by the finance industry. So what is responsible investing exactly?

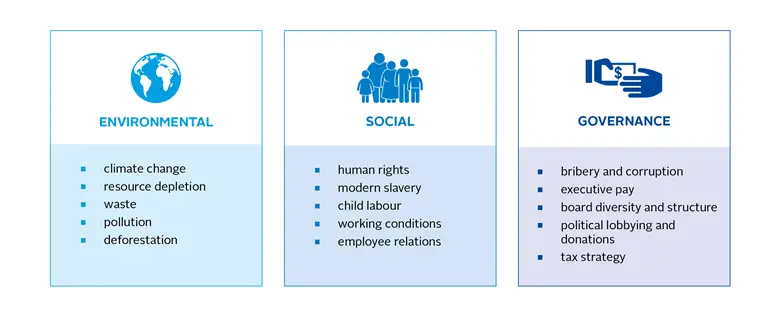

Responsible or sustainable investing is an investment strategy that considers environmental, social and corporate governance (ESG) criteria to generate long-term financial returns and positive societal impact. Sustainable investors aim for strong financial performance, but also believe that these investments should be used to contribute to advancements in ESG practices.

Examples of what ESG factors cover vary but they can include climate change, health and safety in the working environment and protecting the interests of shareholders. Some responsible investors also avoid investing in businesses perceived to have negative social effects. These can be industries such as alcohol, tobacco, gambling, weapons or fossil fuel production. The areas of concern are sometimes also summarised under the heading of ESG matters: Environmental, Social and Governance.

In this article, we mainly focus on environmental investing or ‘green investing’. Green investing seeks to support business practices that have a favourable impact on the natural environment.

Why is green investing important?

I’ve recently covered why investing your money is important in general, but let’s discuss what makes green investing important.

Firstly, extreme weather conditions due to climate change are affecting the production facilities, transport routes and availability of raw materials for many companies. Storms and floods as well as heatwaves and droughts, increase risks to many companies around the globe.

Hence, considering extreme weather conditions when designing production facilities and creating alternative logistics routes may soon be a reality for many companies.

In addition to physical risks, stricter legislation is shaping the operating environment for businesses. Governments and organizations are putting more regulations in place both on national and global levels. Meeting the requirements of the legislation will require companies to invest and change their practices.

With this in mind, responsible investing – especially taking environmental considerations into account as part of investment decisions – has increased. More and more investors want to put their money into environmentally friendly investments. Increased demand is therefore driving companies towards greener solutions.

In other words, the world around us and businesses is changing. Therefore, it is also good for an investor to take climate issues into account when making investment decisions.

The challenges in responsible investing

If you are an index fund investor, you’ll find plenty of choices to choose from. Almost all investing platforms have their own ESG funds nowadays. It’s worth noting that different environmental funds take climate issues into account in different ways. Some funds invest in companies that are either the best in their field when it comes to environmental matters or takes an active part in work against climate change. Whereas other funds might just have climate factors as a consideration.

But how responsible and sustainable are these green funds really?

Sometimes it can be challenging for a private investor to find out how good these funds are. This is because there are no universal criteria and reporting standards for responsible investments. There also isn’t much long-term performance data on ESG investments, which makes it difficult to confidently project potential future returns.

5 tips on how to invest responsibly

Although it might not always be easy to review how responsible different investment options are, there are a few ways to identify them. Here are five tips on how to invest responsibly and sustainably.

1. Assess your current portfolio

In general, the companies that have already taken climate action have a better chance of coping with the tightening legislation and the change in the operating environment.

Collecting information about green investing is the best way to start. If you have already started investing, fantastic! But before looking for new investments, it’s a good idea to map out your current portfolio. For example, a fund investor may ask the fund manager how climate issues have been considered in the fund’s investment strategy.

2. Review the carbon footprint

One way to find out about a fund’s responsibility level is to review its carbon footprint. If you want to invest in an equity fund, compare its carbon footprint to the carbon footprint of the global stock market, for example.

3. Diversify your porfolio

In addition to general climate funds, funds specifically investing in renewable energy have become more popular. These funds can be a good addition to an environmentally conscious investor – as long as they fill only part of the portfolio. Like with any investing, diversification between different industries is also essential for responsible investing.

Instead of investing in funds investing in a niche sector, it’s worth considering more diversified investments as the cornerstone of your portfolio.

4. Consider a variety of industries

If you decide to pick your own stocks instead of investing in funds, a more comprehensive approach might be needed. You can find green companies, especially in the renewable energy and circular economy industries. However, it’s a good idea to look into companies in other sectors as well.

For instance, you could look for companies in different industries that have emission reduction targets and that take action in favour of these issues.

There are companies in many industries that have found opportunities in a changing situation instead of just risks. Good examples can be found in the car industry, for example.

5. Do research around companies' environmental goals and actions

When comparing companies’ climate impact, it’s worth getting to know their responsibility work through the website and the responsibility report. It’s important to understand what kind of environmental goals a company has, how it’s progressing in those goals, and what related figures and information it publishes. Pay attention to their energy-saving and carbon neutrality targets and whether the company reports its annual greenhouse gas emissions.

In addition, it is important to consider how relevant a company’s climate goals and actions are to its business. For example, if an industrial company that owns production facilities only communicates about its paperless office, then alarm bells should ring. Although a paperless office is a good thing, the most significant emission reductions would likely be achieved in their production facilities.

Is responsible investing worth it?

One of the main benefits of responsible investing is that you can use your money to align with your values. Taking environmental factors into account as part of an investment decision is not only a way to help to change the world but can also be more profitable. Especially in recent years, more responsible investment strategies have outperformed other strategies.

With any type of investing, there are potential risks. If you want to make sure your entire portfolio is composed of ESG or SRI investments, it may come at a cost. Therefore, be careful with balancing your values with your financial goals.

Related: 17 Eco-Friendly Ways to Save Money

This is really helpful. I’ve always been scared of investing but this info has helped me to want to make a start.

Thanks, glad to hear this helped you to learn more about responsible investing 🙂

Great post! I’ve recently become more interested in investing and so this helped me a lot.

Thank you! Good to hear this helped you to understand investing, and sustainable investing in particular, a bit better. Good luck with your investing journey!

Love this! I have started diverting part of my investing money each month into a sustainable fund within my investment broker. Its a small thing but makes me feel like I am doing something to combat the junk going on in the world. Thanks for a great post!

Thank you! That sounds great – good example of how easy it can be to invest responsibly and sustainably!

When it comes to investing responsibly and sustainably, there are several key steps you should take before making a commitment. First, do your research and make sure you understand what you’re investing in, how it works and how it impacts the environment or society. Secondly, be mindful of where your money goes – look for companies that prioritize sustainability efforts or adhere to social responsibility policies when possible. Finally, check out green investment opportunities like renewable energy projects or sustainable agriculture initiatives which provide support for environmentally responsible businesses while still offering a return on your investment.